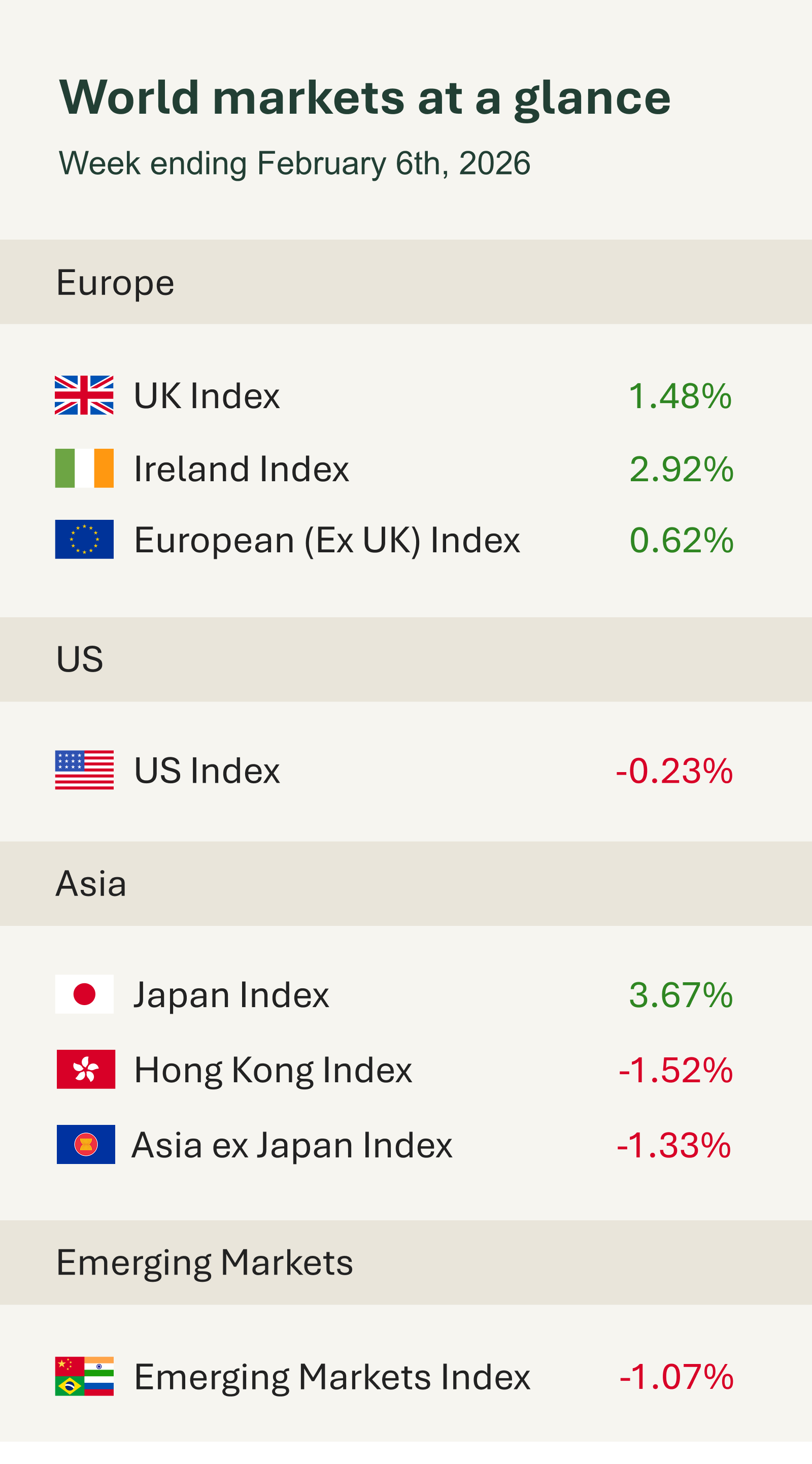

As shown in the accompanying table, global equity markets delivered mixed results over the week, with UK and European markets outperforming the US. Market performance was influenced by a combination of uneven corporate earnings and ongoing geopolitical uncertainty.

Technology stocks were a key source of market weakness earlier in the week. Concerns around the disruptive potential of artificial intelligence, alongside questions about whether current investment levels can be justified by future profitability, weighed on sentiment. Even as companies delivered robust earnings, Big Tech’s aggressive AI spending plans present a challenge for investors. While Friday’s rebound helped stabilise near-term sentiment. The Dow Jones Industrial Average rose 2.47%, while the S&P 500 and Nasdaq Composite gained 1.97% and 2.18%, respectively. Despite this late-week rally, overall weekly performance remained mixed, with the S&P 500 edging down 0.1% and the Nasdaq declining 1.8%.

The STOXX Europe 600 rose 1.00% as optimism around the eurozone outlook improved. The UK’s FTSE 100 gained 1.43%, supported by valuation appeal and defensiveness. Japanese equities outperformed, with the TOPIX gaining over 3.5 %, driven by positive domestic sentiment ahead of the February election.

In the UK the Bank of England’s Monetary Policy Committee voted to hold interest rates at 3.75%, following a closely split decision. Five members supported holding rates, while four voted for a 0.25% cut.

Governor Andrew Bailey voted to keep rates unchanged but noted that he could “see scope for some further easing of policy.” He reiterated his view that inflation, measuring the pace of price growth, is expected to fall close to the Bank’s 2% target from spring onwards, earlier than the previous expectation of 2027.

“That’s good news,” Bailey said. “We need to make sure that inflation stays there. All going well, there should be scope for some further reduction in the Bank Rate this year.”

Lower interest rates reduce the cost of capital for businesses and make borrowing more affordable for consumers, supporting demand through cheaper mortgages and loans. However, this easing also tends to weigh on returns for savers.

Further easing would therefore provide a welcome boost to both corporate activity and consumer demand, factors that are generally supportive for markets.

Also on Thursday, as widely expected, the European Central Bank held interest rates steady for a fifth consecutive meeting, keeping the deposit rate at 2%.