Global markets ended the week in a more cautious mood after a strong start to January, with equities consolidating near record highs as investors digested earnings, shifting policy signals, and renewed geopolitical noise. In the U.S., major indices briefly touched fresh highs before easing back. The S&P 500 and Nasdaq finished broadly flat for the week, while the Dow Jones Industrial Average slipped modestly, weighed down by weakness in financial stocks. Softer U.S. inflation data initially supported risk appetite, but better-than-expected jobless claims later in the week tempered expectations for near-term Federal Reserve rate cuts, limiting further upside.

The U.S. banking sector was a focal point this week. Shares of Wells Fargo fell sharply after weaker-than-expected fourth-quarter revenue, while Bank of America and Citigroup declined despite beating consensus estimates. These moves compounded losses earlier in the week following President Donald Trump’s call for reform of credit-card interest rates, which raised concerns about future profitability in consumer banking. In contrast, investment banks including Goldman Sachs and Morgan Stanley outperformed after delivering stronger results, helping stabilise sentiment later in the week. Technology stocks also found support after Taiwan Semiconductor Manufacturing reported a strong rise in quarterly profits, reinforcing confidence in the artificial-intelligence investment theme.

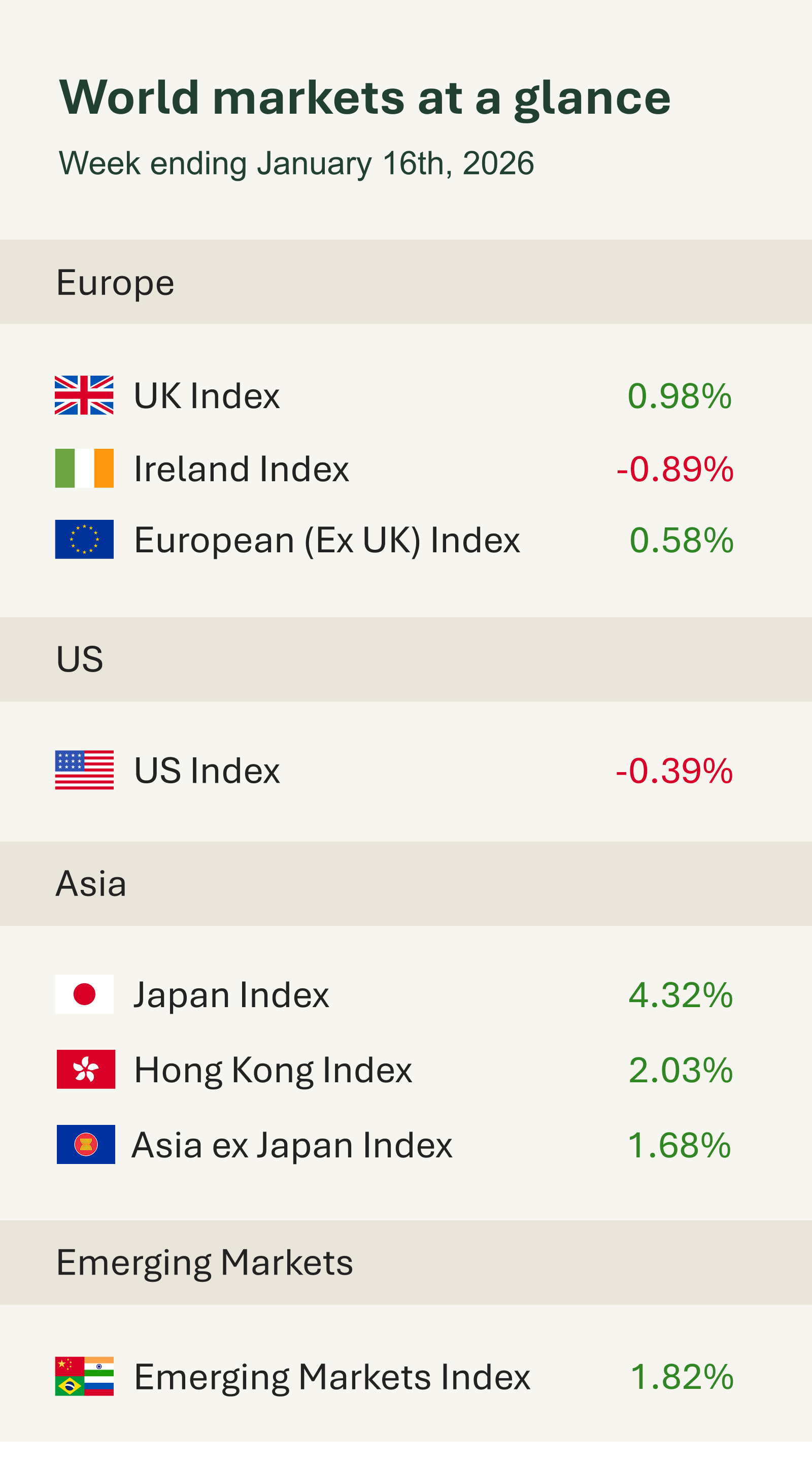

European equities continued to outperform. Markets were supported by easing oil prices, resilient economic data, and strong performance from semiconductor stocks following TSMC’s results.

The UK’s FTSE 100 gained over 1%, buoyed by energy and mining shares, while UK economic data surprised to the upside. GDP expanded by 0.3% in November, returning the economy to growth after two months of contraction and beating expectations, with strength in services and manufacturing offering tentative reassurance on the domestic outlook.

In Asia, performance was more mixed. Japanese equities extended their rally, with the Nikkei and TOPIX reaching new highs amid optimism around political stability and the prospect of more aggressive fiscal stimulus following reports that Prime Minister Sanae Takaichi may call a snap election. By contrast, Chinese and Hong Kong markets remained subdued. Although the People’s Bank of China announced targeted interest-rate cuts and signalled scope for further easing this year, investors remained cautious given lingering concerns over domestic demand and the property sector.

Geopolitics and policy headlines added to uncertainty but stopped short of disrupting overall market momentum.