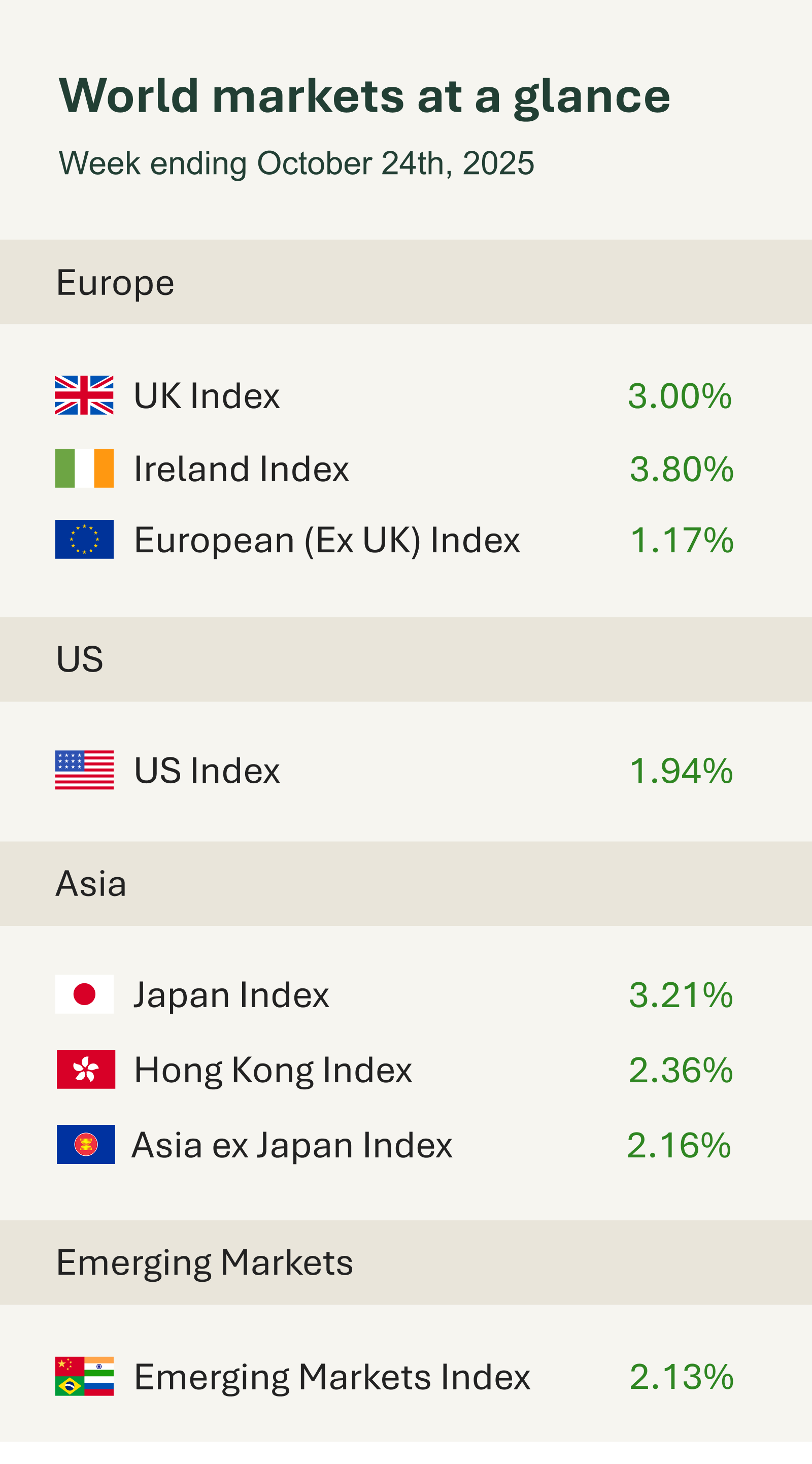

Global equities delivered strong gains this week, with investors looking past a series of volatile headlines to focus on improving sentiment and resilient economic signals. UK’s FTSE 100 Index climbed an impressive 3.11%, buoyed by strength in energy and financial stocks. Stocks shrugged off renewed tensions between the U.S. and China, as well as a jump in oil prices following fresh U.S. sanctions on Russia’s two largest oil companies.

The internationally focused FTSE 100 recorded its strongest weekly rise in over six months, with improving UK data and policy expectations supporting risk sentiment ahead of several key central bank meetings.

UK retail sales beat expectations, rising 1.5% year-on-year and 0.5% month-on-month in September, marking a fourth consecutive monthly increase. Growth was driven by non-food stores, especially clothing, and continued strength in online spending, which posted its eighth straight monthly rise. The data indicates that consumer demand is holding firm, helping to underpin near-term growth expectations and easing fears of an immediate slowdown. Sterling and UK retail shares both found modest support as a result.

In the UK, consumer confidence rose to -17 in September from -19, defying forecasts for a further dip. Although sentiment remains subdued, the improvement suggests households are becoming slightly more optimistic ahead of the Black Friday sales period. Combined with stronger retail figures, this points to ongoing consumer resilience despite fiscal uncertainty in the run-up to the November Budget.

The UK’s Manufacturing PMI rose to 49.6 in October from 46.2, signalling a slower pace of contraction. Restocking and a tentative rebound in domestic demand helped offset trade headwinds and lingering supply chain disruptions following the Jaguar Land Rover cyberattack. Although the PMI activity remains just below the 50 mark separating expansion from contraction, the improvement points to stabilising conditions.

Meanwhile, the Services PMI edged higher to 51.1 from 50.8, indicating modest expansion. Firms cited weak consumer sentiment and delayed investment decisions ahead of the Budget, but optimism for the year ahead improved. Taken together, the PMI data suggests the UK economy is regaining some momentum heading into the fourth quarter, supporting the view that the Bank of England can afford to move gradually with any future rate cuts.

Asian markets had a strong week. Japan’s Topix Index jumped 3.12% after Sanae Takaichi became prime minister, boosting investor confidence with her pro-growth stance. In China, a four-day Communist Party meeting signalled support for tech self-reliance and domestic consumption, encouraging demand-linked sectors.