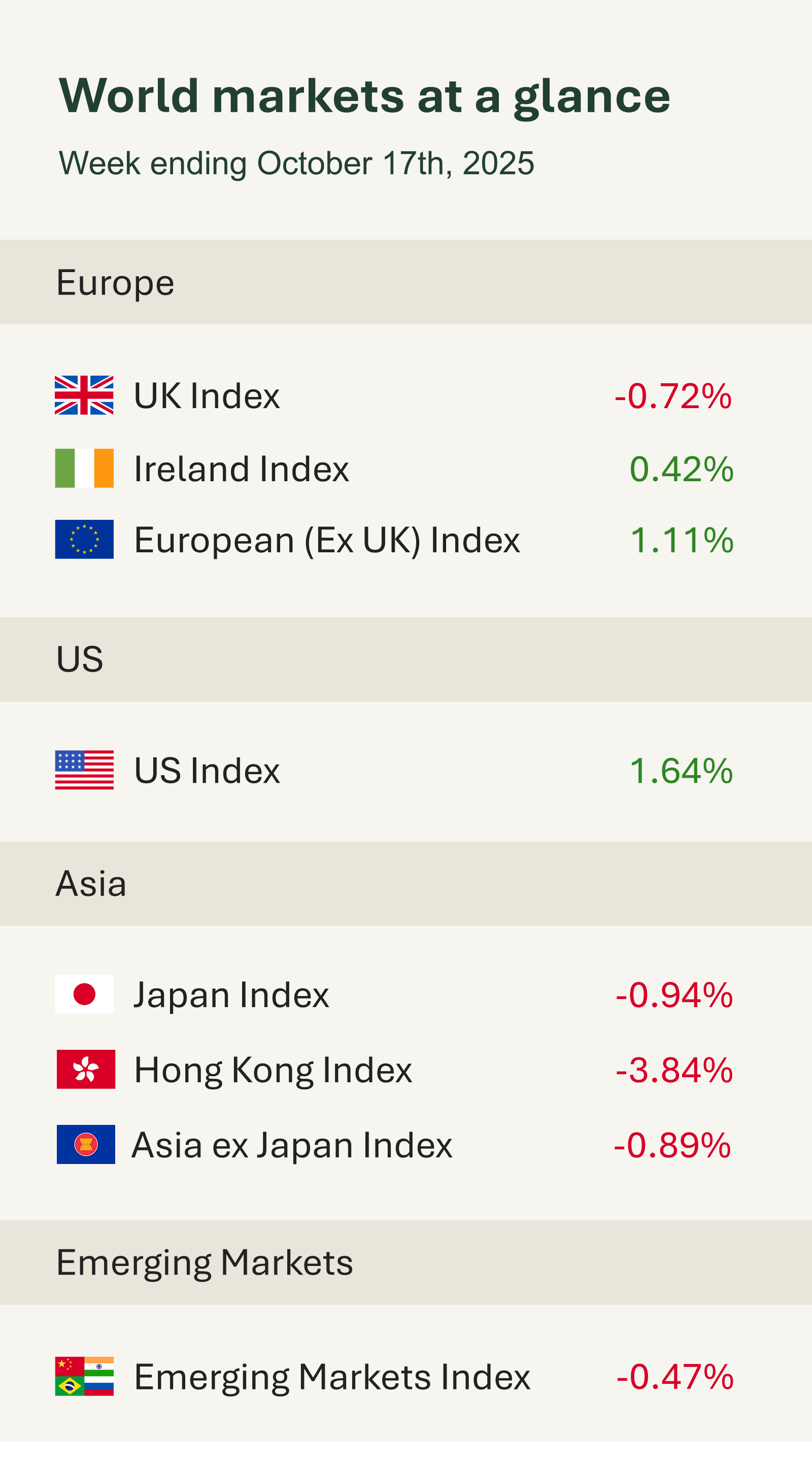

As can be seen from the accompanying table, markets ended the week broadly lower.

UK GDP grew by 0.1% in August, following a revised 0.1% contraction in July and broadly matching market expectations. The modest expansion was driven by gains in manufacturing and utilities, which pushed overall production output up by 0.4%. While some sectors continued to contract, economists see the latest data as a sign that the UK economy remains on stable ground ahead of Chancellor Rachel Reeves’ fiscal budget in November. A degree of cooling is expected after a strong start to the year, particularly as households contend with a “higher for longer” interest rate environment (despite recent cuts) and inflation that remains elevated at 3.8%. Nonetheless, this growth keeps the UK on course to meet the IMF’s forecast as the second-fastest-growing G7 economy in 2025, supporting the Bank of England’s decision to maintain its current policy pause.

On Thursday, some ECB officials indicated that the ECB may be nearing the end of its rate-cutting cycle, a view supported by the latest Eurozone inflation data. Inflation rose to 2.2% year-on-year in September, slightly up from 2% in August, nudging price growth marginally away from the ECB’s 2% target. Core inflation, which excludes volatile items like food and fuel, increased to 2.4%, from 2.3% the previous month. The ECB, one of the first central banks to ease policy amid regional economic weakness, has kept rates unchanged in recent months, mindful of avoiding over-intervention when the evidence doesn’t demand it. Given that inflation is still relatively close to the target, the market is largely pricing in a decision to leave rates unchanged at the ECB’s meeting later this month.

In global trade developments, speculation swirled on Wednesday after President Trump claimed that India had agreed to stop purchasing Russian oil, something that, if true, could increase pressure on the Kremlin to withdraw from its occupation of Ukraine. Recently, the U.S. administration imposed a 25% penalty tariff on India for continuing to trade in Russian oil, a levy that could potentially be lifted if last week’s rumours prove accurate. Oil prices fell on Friday in response to the reports, with Brent crude futures slipping 0.79% to $60.58 a barrel. By late Thursday, even while Indian officials dismissed any suggestion that the country was cutting ties with Russian suppliers, sources within India’s refining sector are said to have indicated that some refiners are preparing to reduce Russian oil imports due to payment challenges linked to U.S. sanctions.

Over in China, the September CPI data again underscored ongoing weakness in domestic demand. Prices fell 0.3% year-on-year, a slight improvement from the 0.4% decline seen the previous year.