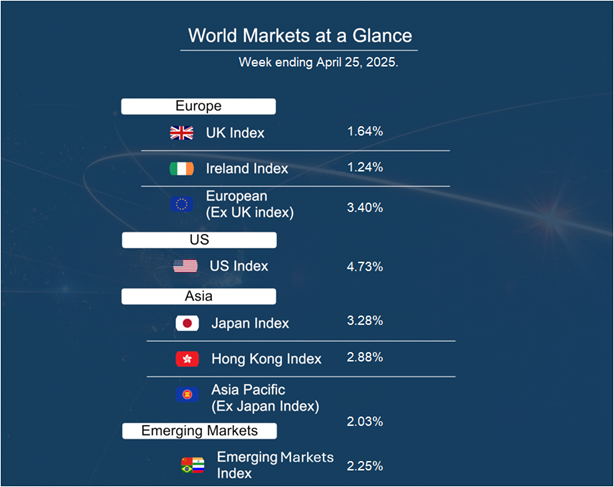

As you can see from the accompanying table, global markets staged an encouraging rebound this week, with renewed investor optimism helping to drive gains after U.S. stocks wobbled on Monday. Signs of easing trade tensions provided a key source of support.

U.S. equities climbed as President Trump softened his stance on China trade policy, helping to stabilise markets after recent volatility. Investor sentiment was further lifted when he backed away from threats to dismiss Federal Reserve Chair Jerome Powell. A three-day relief rally followed, driven by hopes that tariff tensions may be easing and could lead to more constructive negotiations. While some market turbulence is likely to persist, there’s a growing belief that tariffs may have peaked and will be substantially lower than previously proposed.

Optimism for trade progress grew further amid reports that China is considering suspending certain retaliatory tariffs and that U.S.-Japan trade talks are advancing positively. Speculation emerged that Beijing may lift its 125% tariffs on select U.S. goods, fuelling hopes of a potential breakthrough in U.S.-China relations. While some businesses confirmed that China had exempted specific U.S. imports from these steep tariffs on Friday, Chinese officials quickly dismissed President Trump’s claim that formal negotiations were already in progress.