Individuals are being urged to prepare for significant changes to the way pensions are to be treated under Inheritance Tax (IHT).

Currently, when someone dies, the first £325,000 of their estate is tax-free under the Nil Rate Band (NRB). If they leave their home to direct descendants (like children or grandchildren), they may also benefit from an extra £175,000 tax-free allowance called the Residence Nil Rate Band (RNRB). However, for estates worth more than £2 million, the RNRB is gradually reduced and can be lost entirely.

From 6 April 2027, unused defined contribution (DC) pensions will be included in an individual’s estate for IHT purposes. This means that if someone dies with pension savings still in place, those funds could be taxed at 40%, just like other assets such as property or investments. For families with large estates, especially where the RNRB is tapered away, this change could result in a combined tax burden of up to 87% on unspent pension savings.

Key changes to IHT on pensions

- Unused pension funds to be taxed – From April 2027, any unused pension funds will be included in the value of an individual’s estate for IHT purposes.

- Responsibility shift – personal representatives (those managing the deceased’s estate) will be responsible for declaring and paying any IHT due, rather than pension scheme providers.

- Provider support – Pension providers must still supply relevant information to assist with IHT reporting.

- Exemptions – Certain benefits remain exempt, including lump sum death-in-service benefits, joint annuities, dependants’ pensions and charity lump sums.

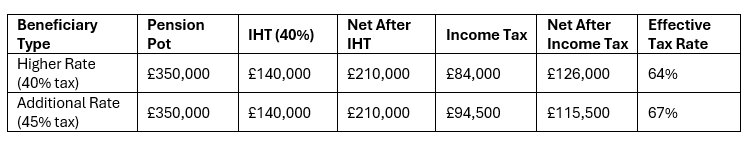

Tax breakdown

For estates that have already used their nil-rate bands, the pension pot will be taxed at 40% IHT. Additionally, if the deceased was over 75, beneficiaries will also pay income tax on withdrawals at their marginal income tax rate. This combination can result in an effective tax rate of up to 67%. See table below: