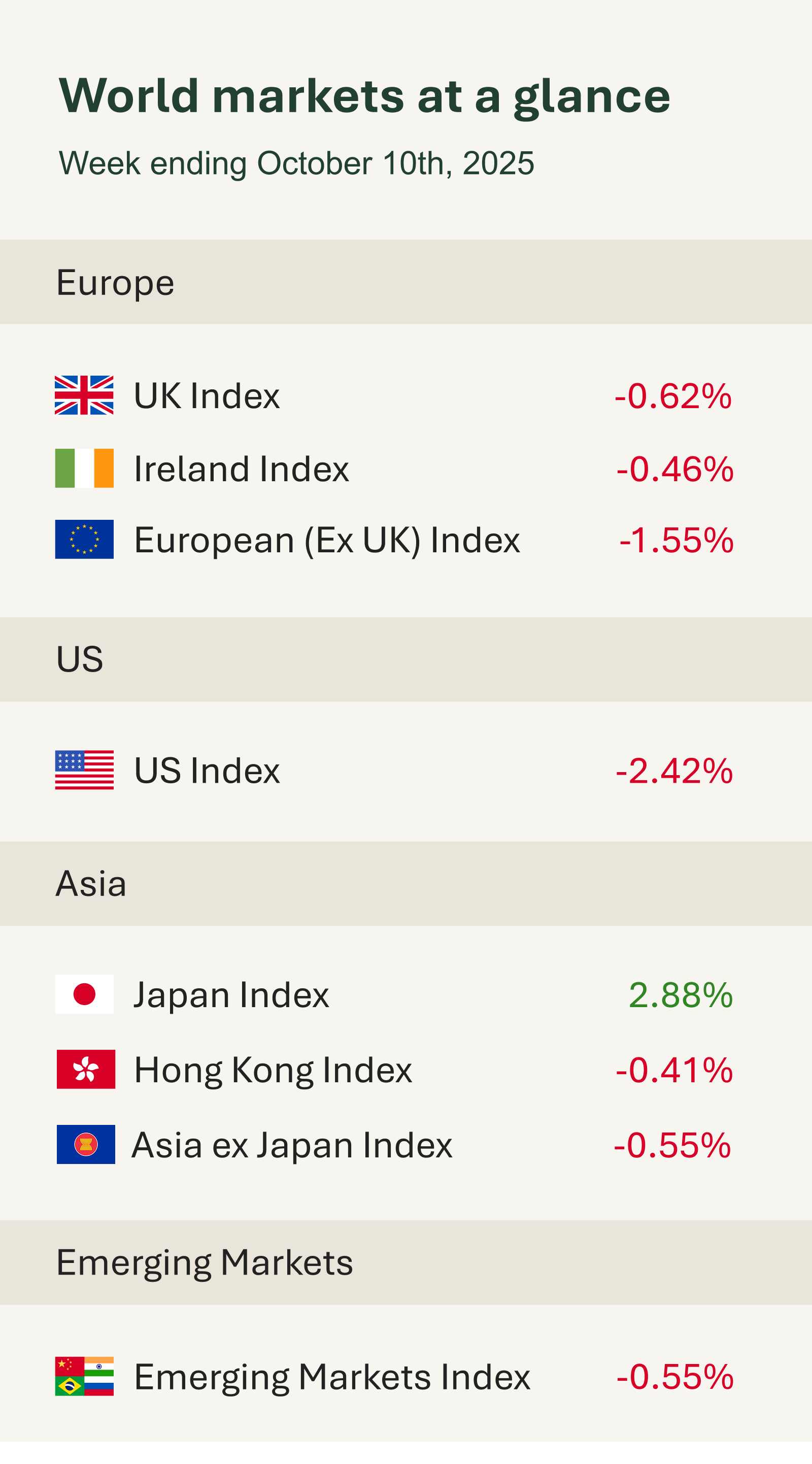

Markets ended the week in negative territory, as shown in the accompanying table, despite a strong start driven by optimism around artificial intelligence and robust performance from technology stocks. Investors initially shrugged off concerns surrounding the ongoing U.S. government shutdown, with sentiment buoyed by a sharp rally in Advanced Micro Devices (AMD). The chipmaker surged more than 20% on Monday following news of a strategic partnership with OpenAI, helping lift broader market confidence.

However, gains were swiftly erased late Friday, after President Donald Trump announced a sweeping escalation in trade tensions with China. The U.S. will impose an additional 100% tariff on Chinese imports beginning 1 November, citing what Trump described as an “extraordinarily aggressive position” by Beijing. He also unveiled plans to restrict exports of all critical software to China, in response to Chinese controls on rare earth materials. U.S. markets closed sharply lower, though the announcement came late in the session for UK and European markets, limiting its immediate impact abroad. In an apparent attempt to cool tensions over the weekend, President Donald Trump said Xi Jinping “had a bad moment” when announcing new export controls on rare earths and critical minerals.

Uncertainty remains over whether Trump and Xi will meet at the South Korea summit later this month.

While such headlines often rattle investors, tariff-related noise is far from new. Similar flare-ups earlier this year most notably in April triggered brief volatility but were quickly followed by market rebounds. These episodes rarely shift long-term fundamentals. For investors, this underscores the importance of maintaining a diversified portfolio and resisting the urge to react impulsively to short-term headlines. Historically, pullbacks like these have often presented valuable buying opportunities for long term investors.

Elsewhere, the Federal Reserve’s September meeting minutes offered a balanced view of the economic landscape. Policymakers noted persistent inflation pressures alongside signs of a softer labour market, describing risks as increasingly two-sided. While most members supported the case for further rate cuts later this year, some preferred a cautious approach, emphasising uncertainty about how restrictive current policy remains. The minutes reinforced the view that the Fed remains data-dependent and committed to a measured path forward.

European markets also slipped, after touching record highs earlier in the month, as investors locked in profits amidst ongoing political uncertainty in France. Weak industrial data from Germany also weighed on sentiment.