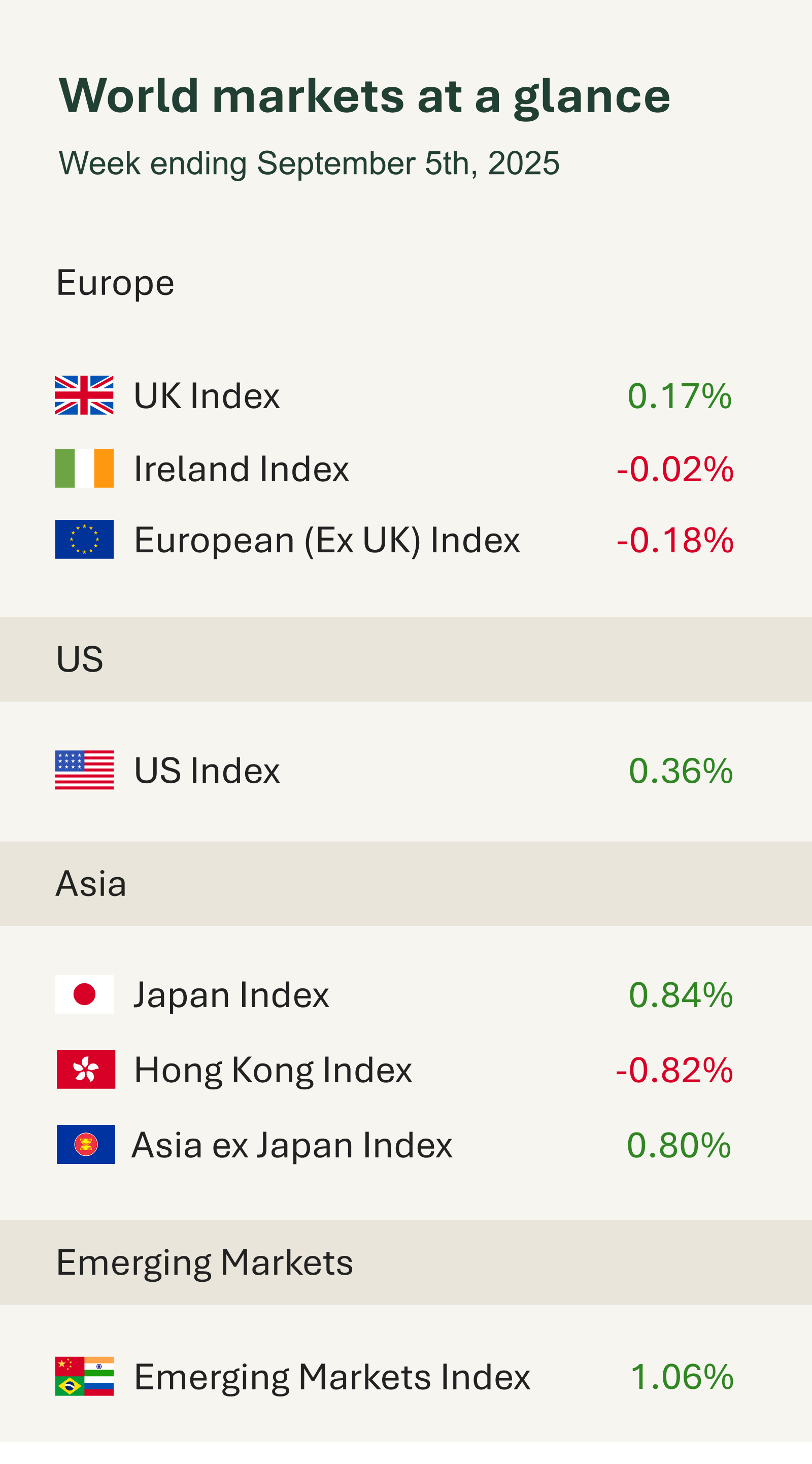

As shown in the accompanying table, it was a relatively positive week for global financial markets.

US equities ended the holiday-shortened week on a mixed note. Tech stocks led the gains, with Apple and Alphabet rallying after an antitrust ruling proved less severe than expected. Smaller-cap stocks also advanced, buoyed by expectations that falling interest rates could offer support. Broader benchmarks were more subdued, with early gains on Friday fading as caution set in.

The catalyst was another disappointing jobs report. In August, US nonfarm payrolls rose by just 22,000, well below forecasts, while the unemployment rate edged up to 4.3% its highest level since 2021. Adding to the gloom, June’s data was revised to show the first monthly job loss since 2020. Beyond the labour market, economic indicators were mixed. US manufacturing remained in contractionary territory in August, although new orders picked up, while services activity continued to expand.

The weaker-than-expected employment data has raised concerns about the health of the economy and heightened the stakes for the Federal Reserve. Markets are fully pricing in a September rate cut of at least 25 basis points, with some probability of a larger move. Fed Chair Jerome Powell signalled last month that economic conditions could justify a rate cut at the Fed’s next policy committee meeting on 17 September.

In Europe, equities were broadly flat. German, French and Italian indices weakened, while the UK managed a modest gain. European labour markets remain resilient, although softer retail sales highlighted uneven demand. Markets are expected to closely monitor next Monday’s confidence vote involving French Prime Minister François Bayrou, with many anticipating he may fall short of the required support. A defeat would likely deepen France’s political instability, casting a shadow over the eurozone’s second-largest economy.

On the domestic front, UK retail trends were mixed. Footfall declined for a fourth consecutive month in August, although high streets saw a weather-related boost. Retail sales volumes exceeded expectations in July, rising 0.6% month on month and 1.1% year on year, supported by clothing sales, warm weather and the Women’s Euro 2025 tournament. However, three-month volumes fell as demand for food and household goods weakened, indicating that household spending remains under pressure from slower wage growth and higher borrowing costs.