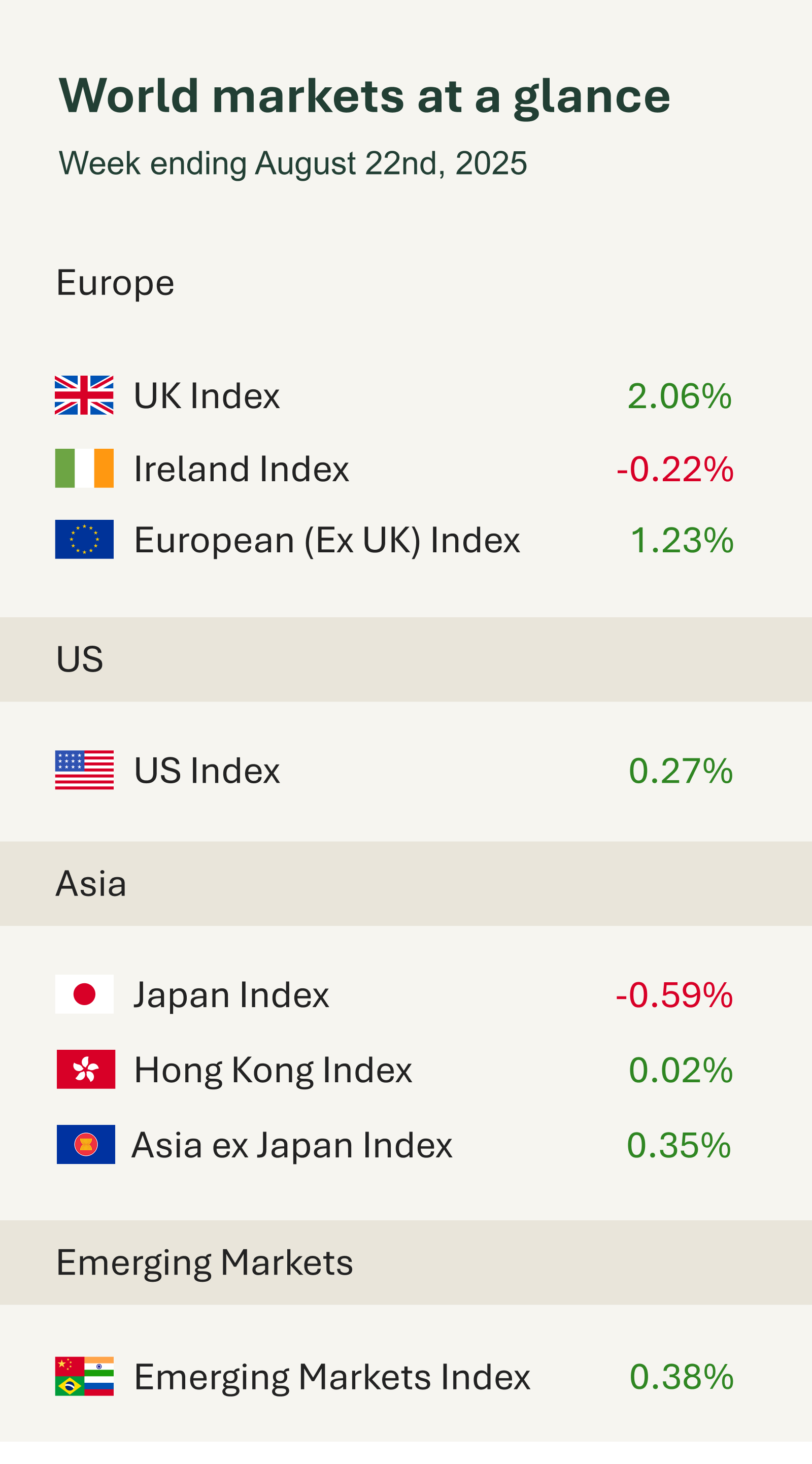

As you can see from the accompanying table global financial markets closed the week on a surprisingly firm footing after a volatile few sessions dominated by US technology losses, weak retail earnings, and anticipation around Federal Reserve policy.

By Friday the S&P 500 in the US had looked on course for a sizeable weekly decline, but a sharp rally triggered by dovish comments from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium lifted the index into positive territory. Markets had been braced for Powell’s remarks all week, with investors looking for clarity on the Fed’s next steps. He stopped short of promising a rate cut but struck a more cautious tone than in recent months, noting that risks to the labour market were increasing even as inflationary pressures linger. His comment that “the shifting balance of risks may warrant adjusting our policy stance” was widely read as a signal that monetary easing could come as early as September.

Powell outlined the Fed’s balancing act: tariffs are still feeding into higher prices, while tighter immigration rules are slowing labour force growth. The combination, he said, creates a difficult environment where inflation risks remain but employment could come under greater strain. Powell’s signal of potential easing amid economic headwinds was taken as a green light by markets, driving rate cut expectations to 80% and reinforcing a supportive backdrop for equities.

Also, this week Purchasing Managers Index (PMI) surveys revealed a mixed economic outlook across regions. PMI is a monthly survey-based index that gauges the health of the manufacturing and services sectors with readings above 50 signalling expansion and those below 50 indicating contraction. In the US business activity accelerated in August, with the composite PMI hitting 55.4 the strongest reading of the year and firmly in expansionary territory. Manufacturing led the way, reaching 53.3, while services growth eased slightly but remained robust at 55.4. However, input costs jumped at the fastest pace since May, driven in part by tariffs, and companies reported passing those higher costs on to consumers. Output prices rose at the quickest rate in two years.