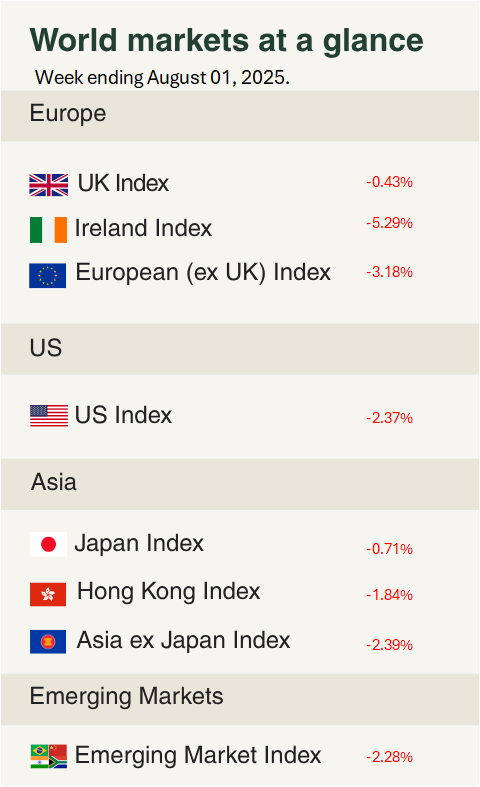

As you can see from the accompanying table, markets lost momentum at the end of the week. It was a week of mixed messages for markets as strong US data, solid tech earnings, and a steady Federal Reserve were overshadowed by geopolitics. President Trump reignited trade tensions with a fresh wave of tariffs, catching investors off guard and sending global equities lower by the end of the week.

The US economy showed surprising resilience in Q2, with GDP rebounding 3% on an annualised basis, far outpacing expectations and reversing the 0.5% contraction seen in Q1, which was heavily distorted by tariff front running causing a surge in imports. Inflation data was broadly in line with forecasts, with the Fed’s preferred core PCE index rising 0.3% month-on-month in June.

Also in the US, the Federal Reserve kept rates unchanged at 4.25%–4.50% for the fifth consecutive meeting. While this was widely expected, two dissenting votes in favour of a cut signalled growing unease within the committee. Chair Powell maintained a data-dependent stance, acknowledging a moderation in growth and inflation still “somewhat elevated.”

US Labour market data, however, told a different story. July’s nonfarm payrolls rose by just 73K, well short of expectations, and the previous two months were sharply revised lower by a combined 258K. The unemployment rate ticked up to 4.2% in July 2025, adding to speculation that the Fed may need to ease policy sooner than anticipated. Rate cut odds for September jumped back above 80% following the report.

Earnings headlines were another major focal point during the week. By Friday morning, earnings had rolled in from 66% of S&P 500 companies and 82% of those have outpaced Wall Street expectations. Big tech provided a temporary lift midweek. Microsoft impressed across the board, with revenue guidance and cloud computing growth both beating expectations. Microsoft is set to spend in excess of $30bn to build out the data centres powering its AI services. Meta also delivered, sending shares up more than 10% on the day. Amazon outperformed on both earnings and revenue but not enough to impress investors, while Apple’s report landed broadly in line with expectations. Despite macro headwinds, the sector’s earnings resilience remains a key support for equities.