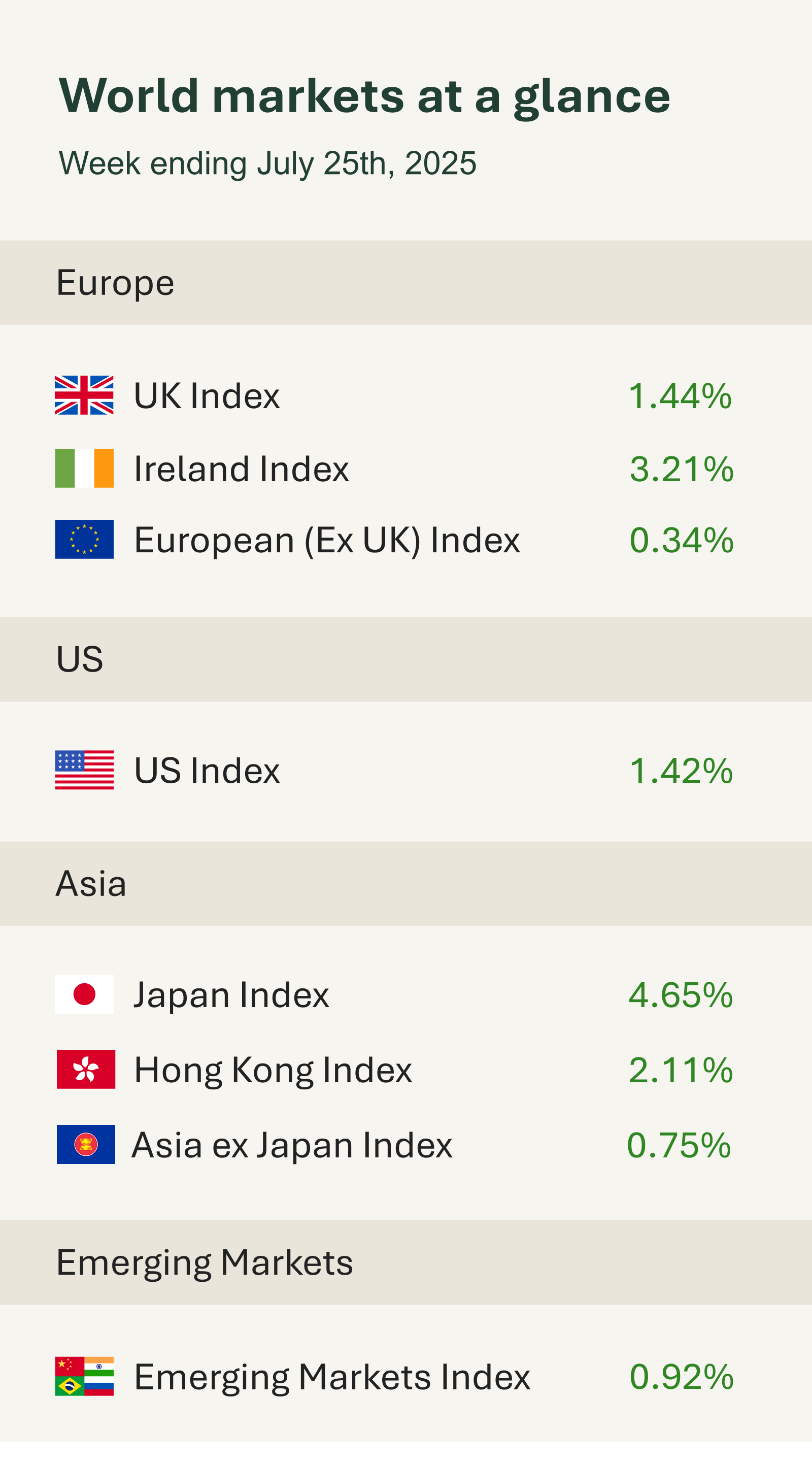

As shown in the accompanying table, equities rallied last week, buoyed by solid corporate earnings and growing optimism on the global trade front.

In the U.S., both the S&P 500 and Nasdaq Composite reached fresh record highs for the second week running. Market sentiment was lifted by announcements of new U.S. trade deals ahead of the 1st of August deadline. The Trump administration secured agreements with Japan, Indonesia, and the Philippines, while signs of progress in EU–U.S. trade talks added to the upbeat tone.

Importantly, and as we expected, President Trump’s initial high tariffs and tight deadlines have led to more moderate, negotiated outcomes. The new agreement with Japan, for example, sets tariffs at 15%, well below early projections. The deal also includes increased U.S. access to Japanese markets and significant Japanese investment into the U.S.

Earnings season also remained in focus. Among the Magnificent Seven, Google’s parent company, Alphabet beat expectations, supported by investor optimism around its AI strategy. In contrast, Tesla missed estimates and saw its share price decline over the week.

On the economic front, flash PMI data pointed to a pick-up in U.S. business activity, led by the services sector. The composite PMI rose to 54.6, while manufacturing slipped back into contraction at 49.5. The upturn was driven by strong services activity, manufacturing output also increased, but at a modest pace, showing a divergence in momentum between sectors.

In Europe, equities were marginally higher, small gains were underpinned by cautious optimism around EU–U.S. trade discussions with the 1st of August deadline approaching. On Thursday, the European Central Bank left rates unchanged but struck a slightly hawkish tone. President Lagarde reiterated the ECB’s 2% inflation target and reinforced the central bank’s data-driven approach. Over the weekend, a long-anticipated agreement was reached, with most European exports to the U.S., including automobiles, set to face a 15% tariff. While higher than hoped, the deal provides businesses with clarity and avoids the risk of a broader trade dispute.

UK equities hit record highs this week, with the FTSE 100 up 1.4% as markets grew optimistic that governments will reach deals with the U.S. to avoid Trump’s proposed tariffs ahead of next Friday’s deadline. The UK has performed well relative to peers, securing a 10% tariff agreement on exports a notable win given earlier fears of steeper duties.