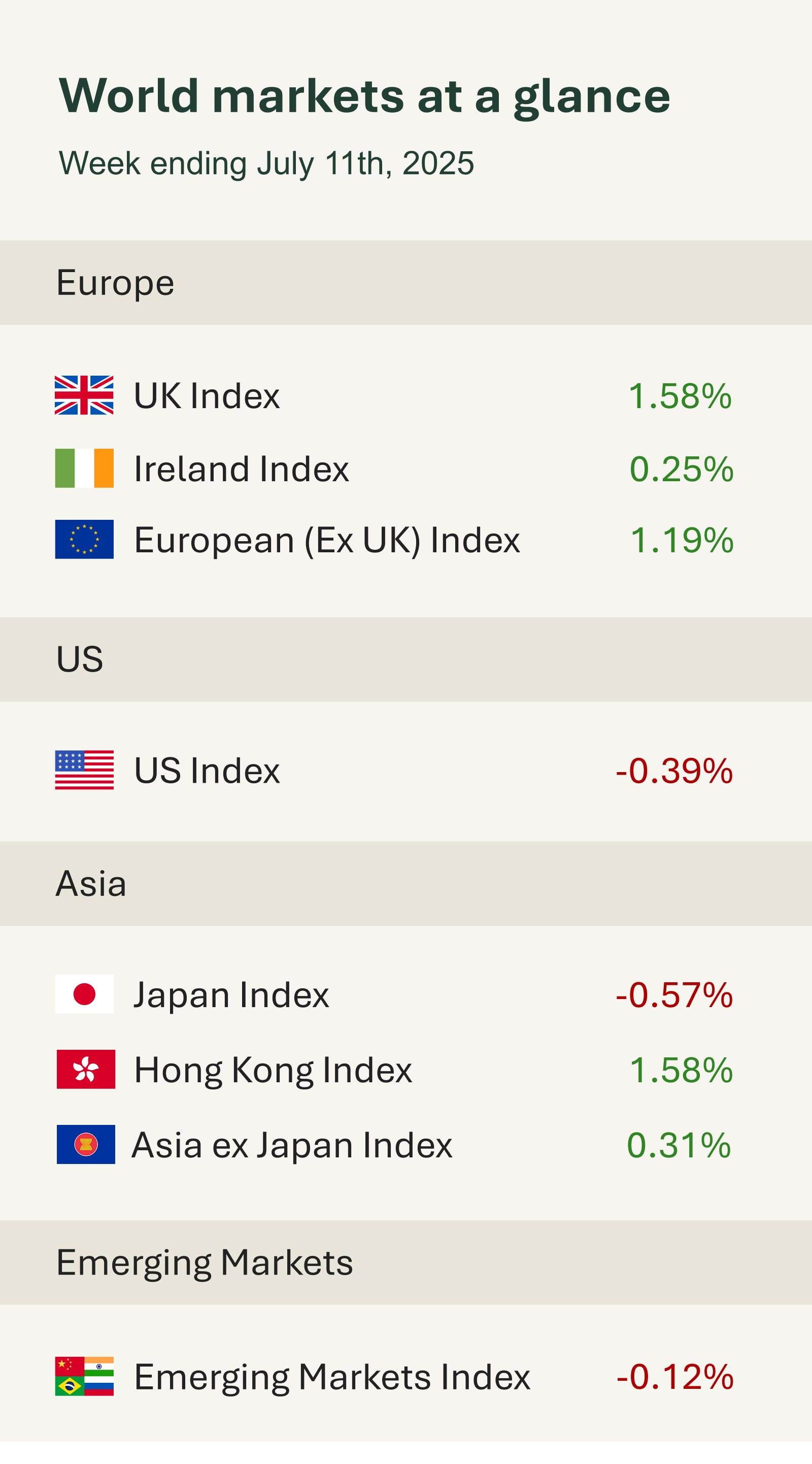

As shown in the accompanying table, markets posted a mixed performance this week. Investors largely took fresh tariff headlines and policy speculation in stride, with some indices even reaching record highs before ending the week on a more subdued note.

While trade tensions once again made their way into the spotlight, markets again took it in stride.

U.S. President Donald Trump proposed a new round of tariffs, including 25% levies on imports from South Korea and Japan, as well as targeted measures affecting Canada, South Africa, Thailand, and Malaysia. Brazil was singled out with a proposed increase to a 50% tariff, a move widely interpreted as politically motivated amid domestic legal proceedings against its former president.

In addition, Trump announced a 50% tariff on copper imports, which prompted a temporary spike in U.S. copper futures, while global prices outside the U.S. saw little to no reaction. While these headlines were significant, markets showed little volatility. Investors appear to be taking a “wait and see” approach this time around, choosing patience over panic as they wait for concrete policy details before pricing in any long-term implications.

Investors focus also turned to the release of minutes from the Federal Reserve’s June meeting, highlighting a degree of division among members about the path forward. While most policymakers still expect to see lower rates before year-end, a few signalled a willingness to act as early as the late July meeting.

Markets responded calmly, suggesting that the range of views within the Fed is already priced in, with investors trusting the Fed to adapt to economic conditions as needed.

Data wise in the U.S., jobless claims fell to 227,000 in the week ending 5 July, the lowest in seven weeks. This marks the fourth consecutive decline, suggesting the labour market remains relatively resilient despite high interest rates.

In Europe, the STOXX Europe 600 Index rose over the week, supported by optimism over future trade negotiations. However, gains moderated toward the week’s end following signals from the U.S. that tariffs on European goods may be under consideration.

UK GDP slipped by 0.1% in May, following a 0.3% decline in April, with softness in the production and construction sectors weighing on output. That said, over the three months to May, the economy expanded by 0.5%, indicating some resilience beneath the monthly fluctuations.