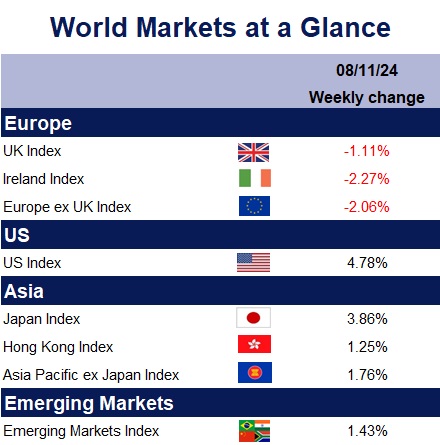

As you can see from the accompanying table it was a mixed week for global stock markets, whose performance was dominated by the US election result announced on Wednesday and somewhat overshadowed key central bank decisions. On Friday, China also kicked off a fresh round of fiscal support for its economy.

US shares hit record highs week, and the dollar posted its biggest intraday gain in eight years as Republican Donald Trump was re-elected to the White House backed up by Republican majorities in the Senate and likely the House of Representatives. Investors are optimistic that a Trump presidency will mean faster earnings growth, reduced regulations and lower corporate taxes. The S&P 500 marked its best performance in nearly a year, closing the week out with a 4.66% gain.

Given Trump’s tariff-heavy stance, global markets digested the potential implications on trade dynamics when Trump takes office in the new year. While tariffs as high as 60% for Chinese goods have been floated during campaigns, Chinese markets were somewhat cautious this week. However, investors also digested the implications of high tariffs on inflation, and led to U.S. government bonds, an important indicator for the global financial system, climbing on Wednesday though the expected rate cut from the Federal Reserve helped bring them back down by Thursday evening.