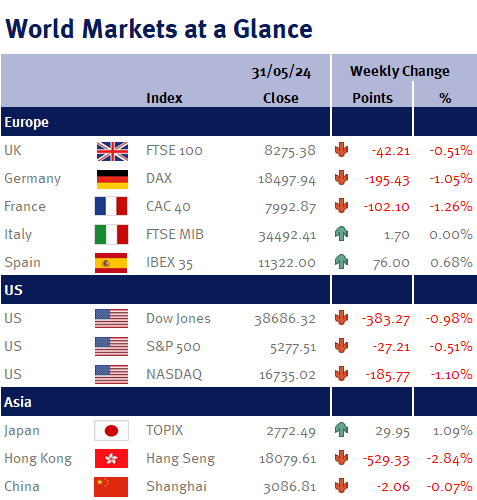

Stocks mostly finished lower in the holiday-shortened week but ended the month with gains. This defied the “Sell in May and go away” adage, which refers to the seasonally weaker historical performance of stocks from May to October.

On Thursday, a week before the European Central Bank (ECB) meets to decide on interest rates, Eurozone unemployment hit a record low of 6.4% in April, below expectations. Fewer women were unemployed than in March (6.7% vs. 6.9%), and youth unemployment also declined. A positive signal for the region amidst a tight monetary policy environment.

However, higher-than-expected inflation data on Friday disappointed investors. Eurozone inflation unexpectedly rose to 2.6% on year in May, up from April’s 2.4% marking the first increase this year. Whilst markets had priced in a small uptick the rise came in above expectations dampening investors’ hopes for a swift shift in the ECB’s monetary policy.

The core inflation rate, which excludes the volatile energy and food sectors, also rose from 2.7% to 2.9% over the same period. This measure is closely watched as it provides a clearer picture of underlying price pressures in the economy.