Thursday’s release of producer price inflation data initially provided a glimmer of relief, with prices rising a modest 0.2% in March, slightly below expectations and well under February’s increase. However, the calm was short-lived as reports of escalating tensions between Israel and Iran saw oil prices gain and earnings reports from major US banks underwhelmed markets. JPMorgan Chase & Co reported a 6% increase in profits, but its net interest income projection fell short of expectations. Wells Fargo beat profit forecasts but posted a drop in net interest income due to weak borrowing demand. Citigroup’s earnings also underwhelmed however, all three banks saw an increase in earnings compared to the fourth quarter as investment banking and trading revenue soared. Q1 earnings continue next week with firms such as Netflix, Goldman Sachs Johnsons and Johnson all set to release reports.

Over in Europe, attention turned to the European Central Bank (ECB), which opted to maintain its key deposit rate at a record high of 4.0%, in line with expectations. However, the ECB hinted that they may be ready to loosen policy nearer the summer contingent upon an updated inflation assessment due later that month. ECB officials emphasised the importance of sustained inflation convergence to the target, signalling a cautious stance towards monetary policy adjustments. Notably, the ECB’s stance appeared to be independent of the recent robust inflation data from the US, reaffirming the bank’s commitment to a data-dependent approach.

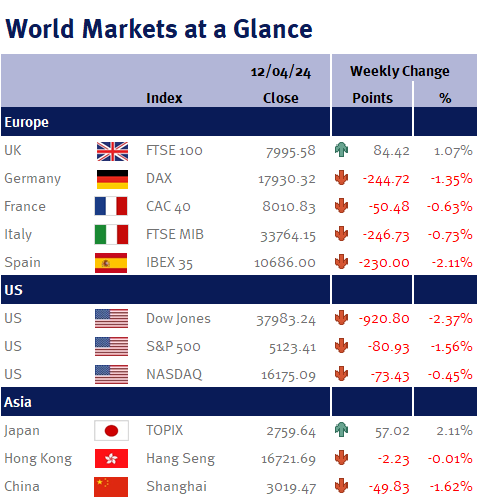

Despite broader market retreats, the UK’s FTSE 100 Index stood out by bucking the downtrend, posting a notable gain of 1.07%. The British pound’s weakness against the US dollar played a pivotal role in supporting the index, buoyed by the favourable conditions for many multinational corporations with significant overseas revenue streams. The UK economy showed signs of resilience, expanding for the second consecutive month. February saw a sequential growth of 0.1% in GDP driven by a rebound in manufacturing output. Moreover, revisions to January’s GDP growth figures suggested a stronger-than-expected performance, indicating a potential exit from recessionary pressures. Over the three months leading up to February, the UK’s GDP expanded by 0.2%, underscoring gradual but steady progress in economic recovery.

Coming up data-wise next week, Eurozone industrial production and US retail sales. In China, a flurry of economic indicators including GDP, retail sales, industrial production, and the unemployment rate. In the UK we can expect unemployment data along with inflation data for March and retail sales. In Japan, the focus will be on inflation data, providing clues about the country’s inflationary pressures and the Bank of Japan’s policy outlook.

Kate Mimnagh, Portfolio Economist