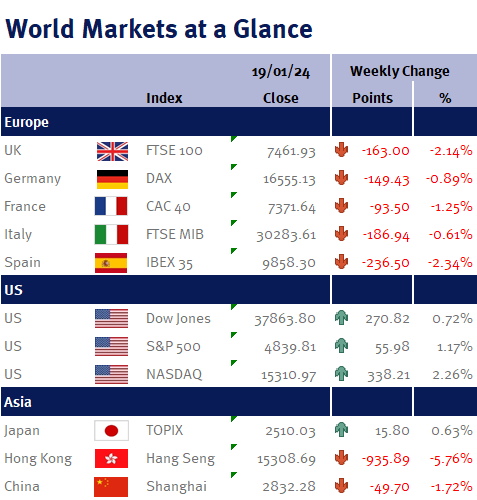

US stocks closed the week higher, with the S&P 500 reaching a record high for the first time in two years, fuelled by a rally in chipmakers and other tech stocks. Booming demand for high-end chips, as noted by Taiwan Semiconductor Manufacturing Company, contributed to the chipmaker stocks’ rise. In addition, US retail sales in December 2023, surpassed expectations and indicate a robust state of the economy. Retail sales rose by 0.6% in December, driven by online sales and motor vehicles. Positive momentum continued as the University of Michigan released a preliminary report on Friday, revealing that the Consumer Sentiment Index for January soared to its highest point in nearly three years, reflecting optimism about inflation and household incomes, which bodes well for the economy’s prospects this year. Consumers’ inflation expectations over the next 12 months were the lowest in three years, providing good news for the Federal Reserve.

Week ending 19th January 2024.

22nd January 2024

At the World Economic Forum in Davos this week, European Central Bank President Christine Lagarde’s comments played a pivotal role in shaping market sentiments, prompting a reassessment of expectations regarding an early reduction in interest rates. Lagarde suggested a shift in the timeline for potential interest rate cuts, indicating that it is “likely” to occur in the summer, contrary to the market’s anticipation of a spring adjustment. However, she maintained a reserved stance, emphasising the need for crucial wage information that would influence the Bank’s policy decision by “late spring”.

Shifting attention to monetary policy developments, the People’s Bank of China (PBOC) injected liquidity into the banking system via its medium-term lending rate but left the lending rate unchanged. Despite the substantial injection, markets were disappointed over unchanged lending rates; however, some view this week’s market reaction as a key buying opportunity for long-term investors due to attractive valuations. In Davos Chinese Premier Li Qiang highlighted his country’s capability to achieve the approximately 5% growth target for 2023 without resorting to an “overwhelming stimulus” to the economy.

There is a heightened sense of anticipation as the PBOC can adjust rates outside policy meetings, leading many to predict a shift towards a more accommodative stance in the coming months to stimulate demand and foster economic growth.

In other news, retail sales in the UK fell in December, marking the sharpest decline since the onset of Covid-19 lockdowns three years ago. The Office for National Statistics (ONS) pointed out that early Christmas shopping, particularly for food items, significantly contributed to the 3.2% fall in sales between December and November. The decline reflects the impact of high inflation and cost of living pressures on consumers, raising concerns about the possibility of the UK economy sliding into a shallow recession towards the end of last year. However, the UK economy has demonstrated resilience, expanding 0.3% month-over-month in November 2023, rebounding from a 0.3% fall in October.

Looking ahead to next week, there is the Bank of Japan (BoJ) rate decision, manufacturing and services PMIs for January from Europe, the UK, and the US, along with the Bank of Canada’s (BoC) rate decision. US GDP for Q4 is also an important release this week. The European Central Bank rate is also due, with markets pricing in no change in interest rates. On Friday, the Fed’s preferred measure of inflation, Core PCE, will be announced.

Kate Mimnagh, Portfolio Economist

The ‘my wealth invest’ app will be available to clients who hold investments with my wealth, which is a trading name of Wealth at Work Limited, part of the Wealth at Work group.

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.