The BoE voted 6-3 to maintain the base rate at 5.25%, emphasizing the need for a prolonged restrictive monetary policy to combat inflation. The minutes showed that policymakers continue to balance the “risks of not tightening policy enough when underlying inflationary pressures could prove more persistent, and the risks of tightening policy too much given the impact of policy that was still to come through”. Policymakers expressed readiness to raise borrowing costs if persistent inflation emerges which is prudent given economic data showed the economy contracted by 0.3% in October, following a 0.2% rise in September. GDP remained flat in the three months to October compared to the three months to July.

Over in Europe the European Central Bank (ECB) also kept interest rates at multi-year highs for the second consecutive meeting. President Lagarde highlighted no discussions on rate cuts, emphasising data-dependency. The ECB revised down growth and inflation forecasts for the euro area, signalling a potential shift in monetary policy. The ECB’s revised forecasts and a call for inflation to slow below 2% by 2026 hinted at potential interest rate reductions.

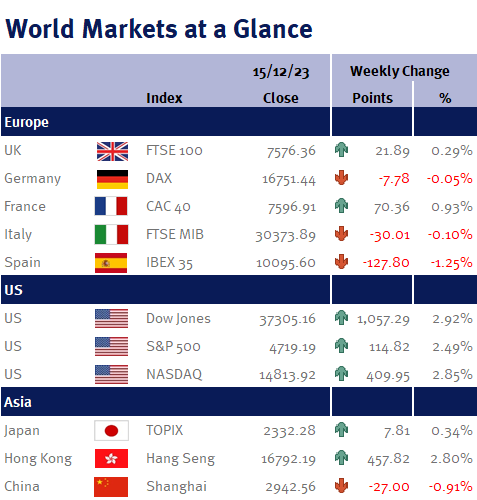

This week, risk sentiment received a notable boost following central bank decisions, with U.S. markets finishing higher, including a 2.49% increase in the S&P 500. The Dow Jones Industrial Average reached a fresh record high, poised for its best weekly winning streak since 2019. On Friday there were positive signs of revival as data showed China’s industrial production rose by 6.6% year-on-year in November 2023, strongly beating market forecasts of 5.6%. It was the fastest pace of growth in industrial production since February 2022. Retail sales also soared rising 10.1% year-on-year in November 2023, much faster than a 7.6% increase in the previous month. Asian markets, especially Hong Kong’s Hang Seng, reflected positive signals within China’s economy.

As we approach Christmas, the upcoming week is relatively quiet on the data front. In the UK, we have CPI data, retail sales, and finalized GDP figures for Q3. In the US final GDP data for Q3, durable goods orders, and core PCE are anticipated, along with interest rate decisions from the Bank of Japan and China.

Kate Mimnagh, Portfolio Economist