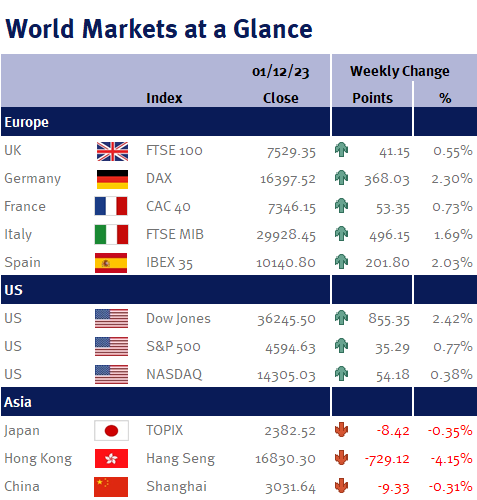

As you can see from the accompanying table markets in the US and Europe ended the week higher. November marked a significant positive shift for markets, bolstered by a series of positive developments: decreasing inflation, a shift in the Federal Reserve’s policy approach, economic resilience despite high interest rates, and better-than-expected corporate earnings. November’s performance set a high benchmark, with the S&P 500 rising 8.9%, marking the best month in over a year and one of the top monthly performances in the past 30 years. Although one month doesn’t define an investment trend, the factors supporting this recent growth could continue to propel the market as 2023 ends.

This week recent data from the core Personal Consumption Expenditures (PCE) Price Index, a key indicator used by the U.S. Federal Reserve to assess inflation, revealed a slowdown in consumer price increases in October 2023. The overall PCE Price Index saw a year-over-year increase of 3.0%, a decrease from the 3.4% rise in September. When food and energy prices, which are known for their volatility, are excluded, the core inflation rate came in at 3.5% in October, slightly lower than the 3.7% increase observed in September.