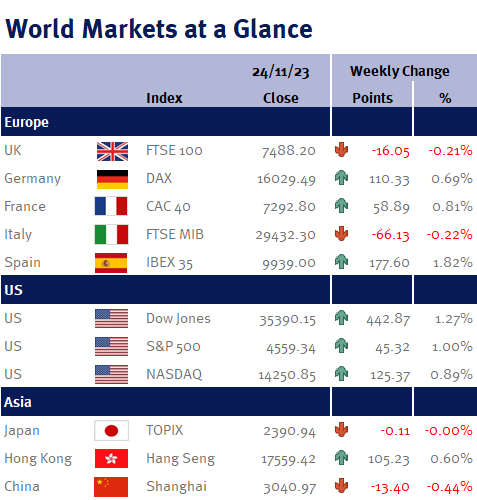

It was a fairly quiet week as markets wound down for the Thanksgiving holiday. In the US, markets closed on Thursday and opened for limited hours on Friday, which meant global markets had to look elsewhere for cues.

In the UK, markets were subdued post Chancellor Jeremy Hunt’s Autumn Statement. Significant cuts to business taxes and National Insurance were highlights, aimed at spurring business investment and economic growth. The UK’s growth projections now stand at 0.6% for this year, with gradual increases expected throughout 2024 and 2025.

UK Consumer Confidence indicator saw an uptick to -24 in November from -30 in October, beating forecasts and reflecting a cautiously optimistic consumer sentiment despite ongoing cost of living concerns.

Over in Europe, Germany’s economy showed a slight contraction of 0.1% in the third quarter. This confirmed initial estimates, signalling challenges with high energy costs and rising interest rates. Germany, Europe’s largest economy, has experienced a particularly tough year.