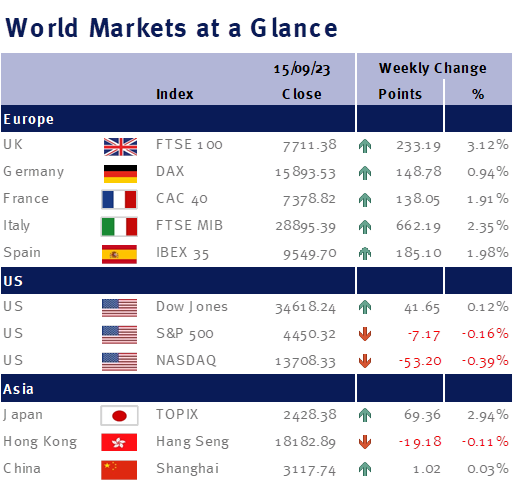

As you can see from the accompanying table markets closed the week mostly higher.

A raft of important economic data sailed out of the US this week.

Giving the Fed food for thought, US CPI headline data reacted to the recent rise in energy prices and rising by 3.7% in August 2023 from the previous year, higher than economists’ expectations. However, core inflation, which excludes volatile elements like energy and food, decelerated to 4.3%, which was slower than the rate of 4.7% we saw in July 2023. The Fed last raised interest rates in July by a quarter-percentage point to a range between 5.25% and 5.50%—the 11th hike since March 2022.

US inflation has crept down steadily from its peak in June of last year and, with the US job market showing signs of loosening, analysts are predicting that it could fall even further in the coming months. The market has not yet priced in if this will provide the Fed with the signal they need to pause additional interest rate increases, but we do not have too long to wait as they meet on the 19 September.