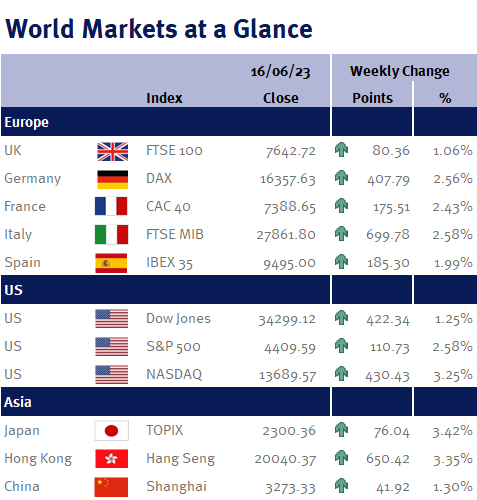

As you can see from the accompanying table markets ended the week higher.

As widely anticipated the Federal Reserve paused interest rate hikes this week. Policymakers met expectations by keeping interest rates unchanged at 5.00-5.25%. Due to long and variable lags associated with monetary policy, we view this as an opportunity for the Fed to take time to assess economic data given the downward trajectory of inflation and signs of a softening economy.

The Fed surprised markets slightly by increasing the terminal rate in the Dot Plot by 50 basis points. The decision was unanimous among the members of the Federal Open Market Committee (FOMC), indicating a more balanced approach. The growth forecast for 2023 was raised to 1% from 0.4% in March, whilst the unemployment forecast was lowered to 4.1% compared to the previous estimate of 4.5%. The pause was made to allow the committee to gather more information and evaluate its implications for monetary policy. During the press conference, Fed Chair Jay Powell emphasised that the final decision for July will depend on the incoming data.