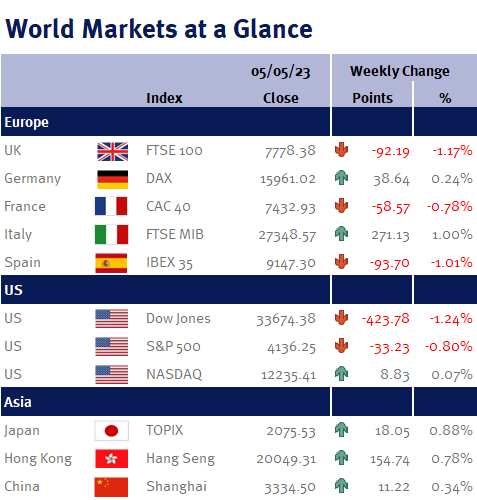

Global equity markets had a mixed week thanks to tug-of-war between the prospect that interest rates are close to their peak levels on one side and recession worries on the other.

The Fed delivered exactly what we were expecting on Wednesday (3 May 2023), when they announced that US interest rates would increase by a further 0.25% and that policymakers were moving to a data-dependent stance going forward.

While in theory this leaves the door open for further interest rate increases, should circumstances dictate, the Fed statement does suggest that this is more likely to be the end of this interest rate cycle as policymakers finally acknowledged what we have been arguing for some months: policymakers need to take into account the fact that their interest rate increases over the past year take time to fully feed through to economic activity, inflation and financial conditions.