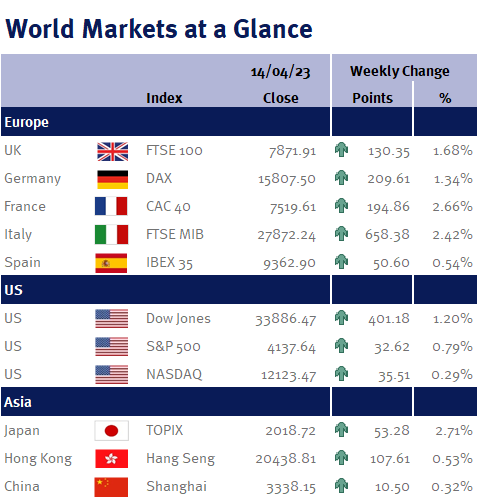

Global equity markets finished the week higher following US CPI inflation data, which suggested that this monetary tightening cycle is nearing its end.

Last week’s US employment data left the door wide open for another increase in US interest rates when policymakers meet on 3 May 2023, but that door is now only slightly ajar as March’s US inflation reading came in at 5.0% – a massive deceleration from February’s 6.0% reading.

Additional optimism that peak US interest rates are close came from comments made by Fed policymaker, Austan Goolsbee (the Chicago Fed President), as he warned that policymakers need to be cautious and evaluate the economic impact of tighter credit conditions on the economy – a clear reference to the fact that the recent banking turmoil has highlighted the economic fragility caused by the sharp increase in US interest rates over the past 12 months.