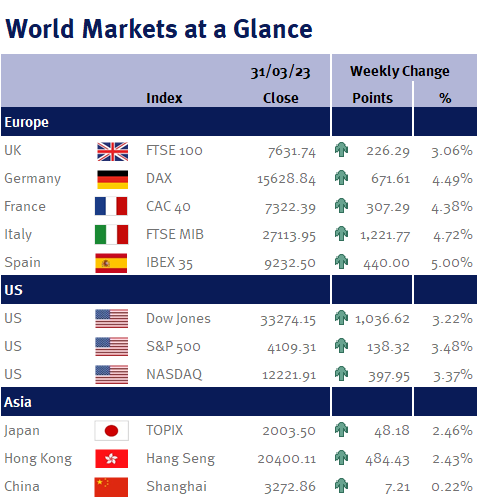

Thankfully calm returned to global equity markets this week after the recent banking-sector uncertainty continued to recede – and as you can see from the accompanying table, equity markets ended the week nicely higher.

Falling inflation readings also contributed to this positivity.

In the US, the Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, slowed quicker than expected in February to 5.0% from 5.3% in January (which was itself, revised down from 5.4%) – which means it has now fallen relatively consistently since peaking last June at 7.0%.

The core PCE inflation reading also came in slightly lower than expected at 4.6% thanks to a 0.3% month-on-month increase in February versus an expected 0.4% increase. January’s reading also saw a downward revision (0.5% from 0.6%).