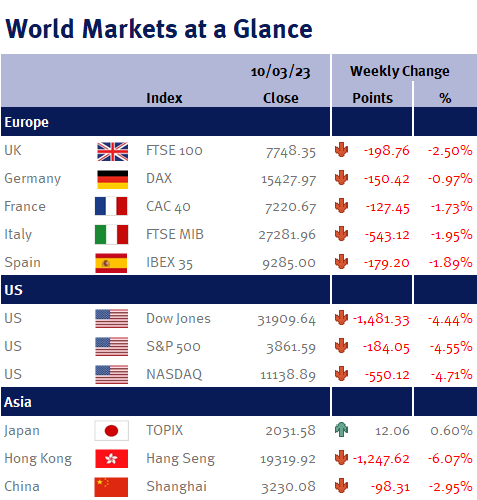

The main focus of this week for global equity markets should have been today’s (Friday 10 March 2023) US employment data.

That was until yesterday, when shares in the US bank, Silicon Valley Bank, fell heavily after it warned about its financial health with a surprise announcement that it planned to raise new capital after a significant loss on its investment portfolio – and unfortunately, global equity markets had a typical knee-jerk response: a fast and violent sell-off.

Whilst we appreciate the scars from the 2008/9 global financial crisis are still relatively fresh, Silicon Valley Bank (which was today, closed by US regulators) is no Lehman Brothers.

Additionally, as there is nothing to suggest there is any risk of a wider systemic contagion in the banking sector, let alone financial markets from Silicon Valley Bank’s collapse, this week’s equity market falls appear to be a predictable ‘panic first and ask questions later’ reaction. As such, it is very important to resist the urge for any knee-jerk reactions and maintain a long-term perspective as we believe it won’t be too long before cooler heads prevail.