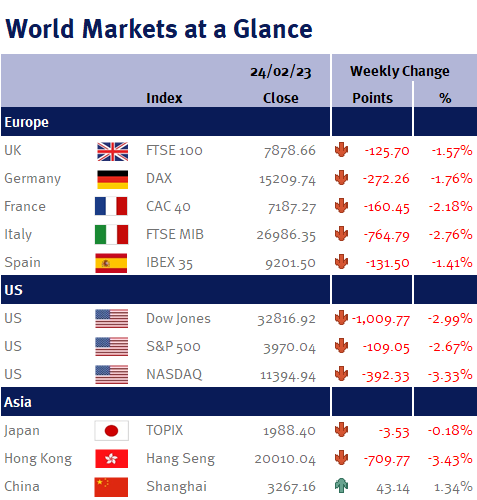

As you can see from the accompanying table global equity markets have had a challenging week as strong company earning statements and economic data releases point to a global economy that is more robust than expected – which in turn heightened speculation that central banks will continue to tighten monetary policy.

For example, the UK’s PMI data showed businesses returned to growth in February for the first time since last July with a reading of 53.0 (50 is the line separating expansion and contraction). Although consensus estimates indicated an improvement from January’s 48.5 reading, it was only to 49.0 – which was still in contraction territory. Likewise, it was a similar story in the Eurozone (with a reading of 53.0, up from 50.8 in January) and the US (50.2 up from 46.8).

UK consumer confidence also jumped strongly (albeit still close to historic lows) – and resilient households bode well for the UK economy as consumer spending accounts for around 60% of the UK’s GDP.