After UK inflation data this week showed inflation cooled to 10.1% year on year in January, retail sales in the UK showed sales increased 0.5% month-over-month in January 2023, rebounding from an upwardly revised 1.2% drop in December with online shops boosted by sales promotions.

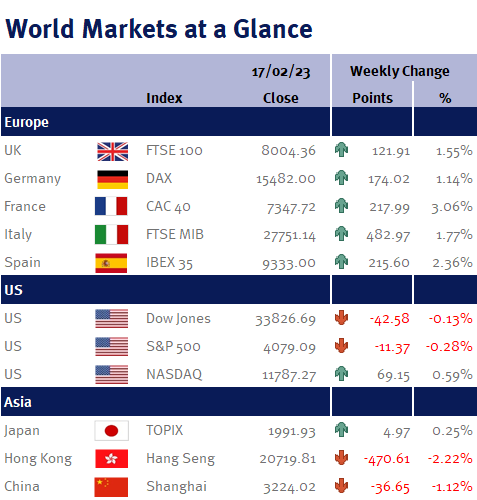

The FTSE 100 index made history this week after it surpassed the 8,000 points mark for the first time on Thursday 16 February. The FTSE 100 index was launched in January 1984 at the base level of 1000 and consists of shares from the 100 biggest UK companies by market capitalisation. As we have spoken about many times, the majority of the companies are internationally focussed and derive their revenue from abroad. Much of the index’s recent success can be attributed to its defensive qualities, namely its high exposure to oil and gas, while the financial sector has also benefited from rising interest rates.

US PPI also increased 0.7% month-over-month in January. The report reaffirmed US CPI data from earlier in the week illustrating that inflation isn’t cooling as quickly or as smoothly as some in the market had originally hoped.