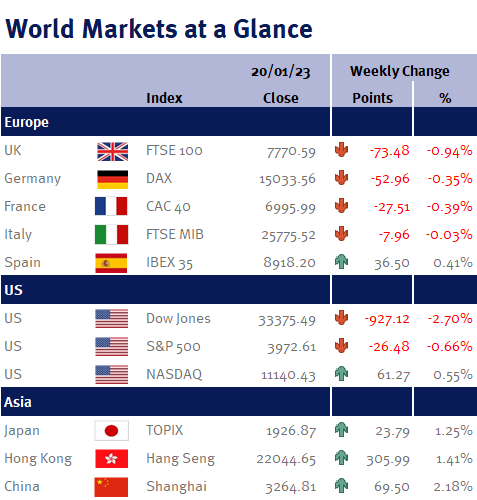

Global equity markets had a mixed week thanks to a tug-of-war between strong Chinese data (please see here) and a number of weak US data points on one side, and comments from Fed policymakers on the other.

This week’s US data (including Empire Manufacturing; retail sales; PPI; and the Beige Book) all indicated that both the US economy and US inflationary pressures are slowing, which should be positive for global equity markets as it could suggest that the Fed should soon end its aggressive monetary tightening.

Unfortunately, Fed policymakers were out in force this week and none of them suggested that the Fed was about to pivot – they all continued to argue that not only were more US interest rates increases needed, but interest rates also needed to stay high. However, as we have said before, it will be easier for Fed policymakers to talk tough now about the need for higher interest rates than it will be to maintain that determination once US economic activity actually starts to contract.

The week ahead will be slightly quieter as a number of east Asian markets will be closed for the Lunar New Year. However, we still have US Q4 GDP; US, UK, Eurozone PMI; US durable goods orders; Irish retail sales; and the University of Michigan consumer sentiment index.

Investment Management Team