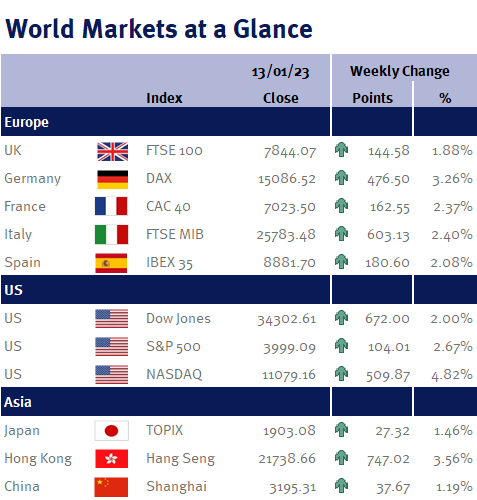

Global equity markets ended the week higher thanks to slowing inflation.

The release of December’s US CPI inflation reading yesterday (Thursday 12 January 2023) was the week’s main event.

And thankfully we weren’t left wanting as the reading slowed from 7.1% to 6.5% – the sixth straight monthly decline since it touched 9.1% in June 2022.

On its own, this slowing US inflation rate is very positive as it confirms to us that an end of the current US monetary tightening is in sight.

The US initial and continuing jobless claims were also released yesterday, and they didn’t provide any indication that the US labour market is coming off the boil – which suggests to us that whilst we are close to peak US interest rates, Fed policymakers are likely to continue talking tough on the need for higher interest rates, and will more likely than not, tighten monetary policy a little further when they next meet on 1 February 2023.

Elsewhere, the UK economy grew 0.1% in November – and having expanded by 0.5% in October, this reading shows that while the UK economy isn’t in a great place, it isn’t as dire as the media likes to portray.