Happy New Year.

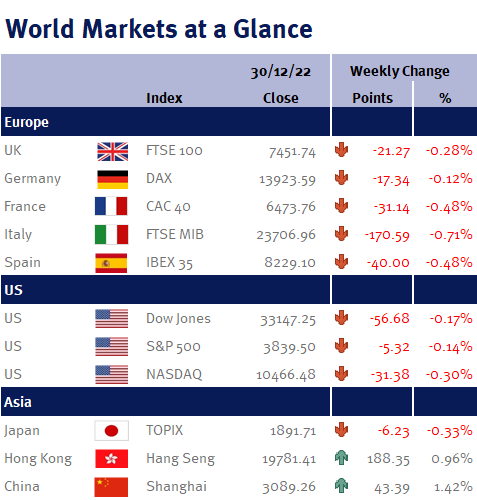

Whilst it has been a horrible year for financial markets (and one that we are pleased to see the curtains finally came down on), thankfully the final week of the year was a relatively quiet one as we had no nasty surprises.

The week’s main story was the record freezing temperatures covering Canada and the US.

Fortunately, the weather across Europe turned milder after a cold start to December – and hence, lower heating demand.

As a consequence, we saw gas prices continue their recent decline: gas contracts for delivery in February fell 10% this week, and whilst they are still elevated, they are now half the level they were in August. This will help to ease inflation readings in the coming months – and hopefully allow central banks to pivot away from their aggressive interest rate increases.