Investment markets can overcome any eventuality, however, during periods of uncertainty they can be volatile. This dynamic was clearly evident during the brief tenure of Truss and Kwarteng, who’s “mini budget” growth plans for the UK economy resulted in UK financial market upheaval. Consequently, this week’s Autumn Statement was hotly anticipated and its measured approach to, “Stability, Growth and Public Services”, which supported by OBR (Office for Budget Responsibility) forecasts, helped investor sentiment.

Communication was sufficiently clear ahead of the statement to manage expectations, as a result there were few surprises on the day. The emphasis of the statement was to support households in the short term, while improving public finances via a combination of windfall and stealth taxes, and spending cuts further down the line. Consequently, the OBR forecast is that household disposable income will fall over the short term which will weigh on economic growth, which is hardly surprising given the intended higher tax take.

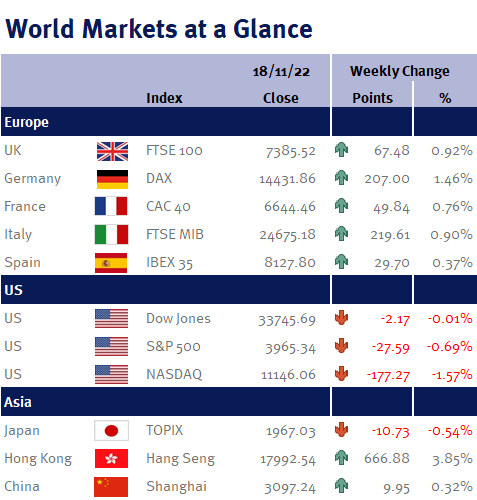

Moves in the UK equity market, Sterling and bond prices were muted as they had already recovered much lost ground in recent weeks. At a corporate level, the share prices of energy producers Centrica, SSE and Drax initially sold off as the increased energy profits levy was announced, however, they closed up given the clarity they now have over the size of the levy. Shares in insurance companies Legal & General and Phoenix, also ended the week positively as the government committed to solvency reforms overhauling EU financial services regulation post Brexit.