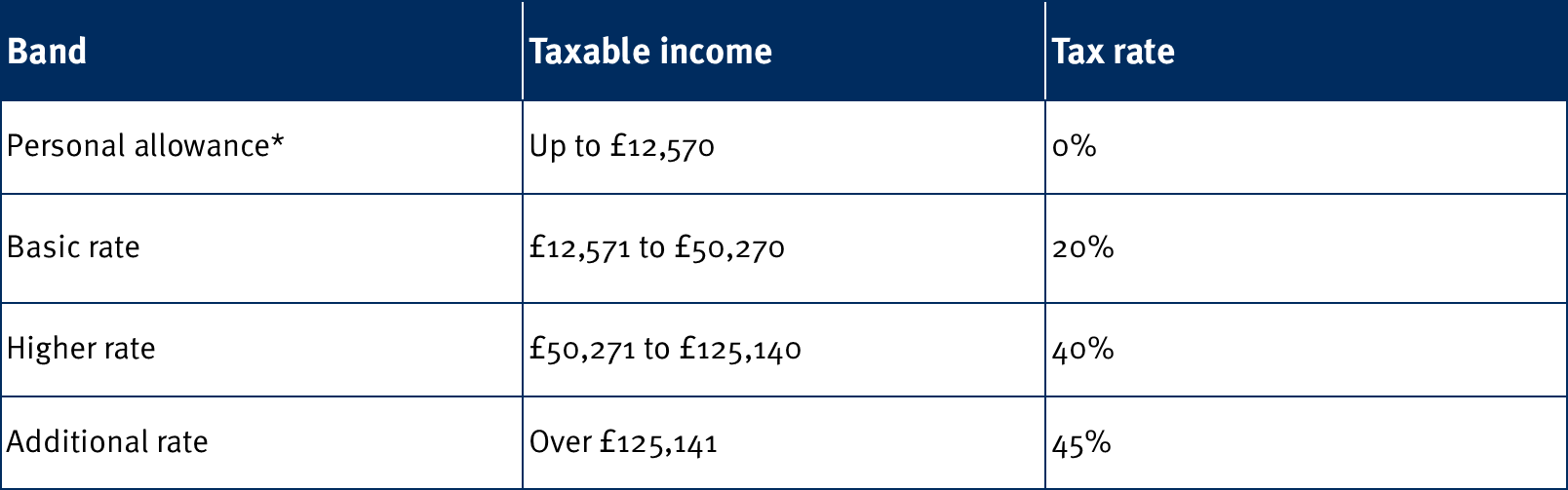

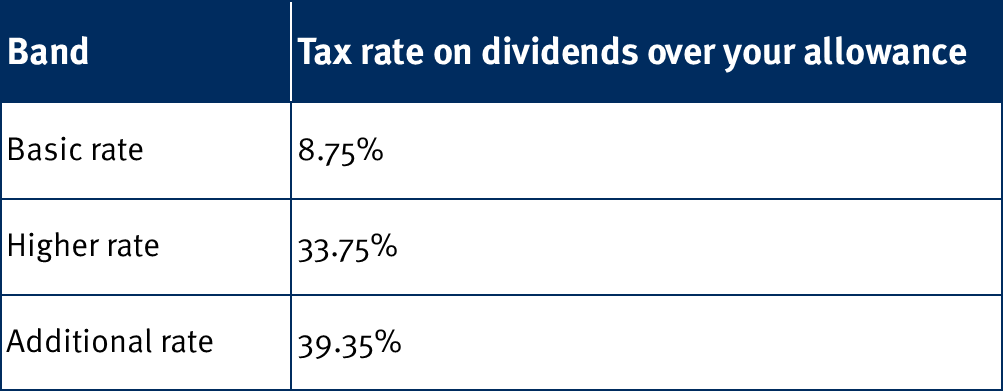

Personal allowance, tax rates and tax bands

The Chancellor Jeremy Hunt has today delivered his Autumn Statement setting out details of his proposed tax rises and spending cuts to raise £55bn to support the UK’s public finances.

Prime Minister Rishi Sunak said the Statement would “put our public finances on a sustainable trajectory” after the market turmoil that followed Liz Truss’s Mini Budget in September, which preceded her and former chancellor Kwasi Kwarteng’s resignation.

Despite the rumours, the Chancellor is keeping with the Conservative 2019 manifesto pledge not to raise the rates of income tax but instead has opted to increase taxes through ‘stealth’. In a practice known as ‘fiscal drag’, this involves freezing the thresholds at which people start paying different rates of tax. Because of inflation and pay increases, people end up paying more tax because more of their income starts to fall within higher tax bands.

Threshold freezes

When Rishi Sunak was chancellor, he introduced a four-year freeze on the personal allowance, the level above which people start paying income tax, at £12,570 from April 2022 until 2025/26. The threshold for higher-rate income tax in England, Wales and Northern Ireland, when people start paying 40% instead of the standard 20% rate, was frozen at £50,270 over the same period. The higher rate was also frozen at £150,000.

This freeze has now been extended by two years to 2027/28 which will mean many more people will be dragged into higher income tax bands.

Also, in a complete U-turn on Kwasi Kwarteng’s plan to scrap the Additional Rate of income tax, Jeremy Hunt has now reduced the threshold for the highest 45p rate from £150,000 to £125,140.

Set out below are the planned tax rates and thresholds for England, Wales and Northern Ireland from 2023/24 which look set to be held at these levels until April 2028: