Wow, what a week. The US may have had midterm elections this week, but the most important moment for financial markets this week was yesterday’s (Thursday 10 November 2022) US CPI inflation data.

At 7.7% headline US CPI was a lot lower than the 7.9% economists had forecast and well below September’s reading 8.2%, while the core reading, which excludes volatile items such as food and energy, also come in lower than expected at 6.3%.

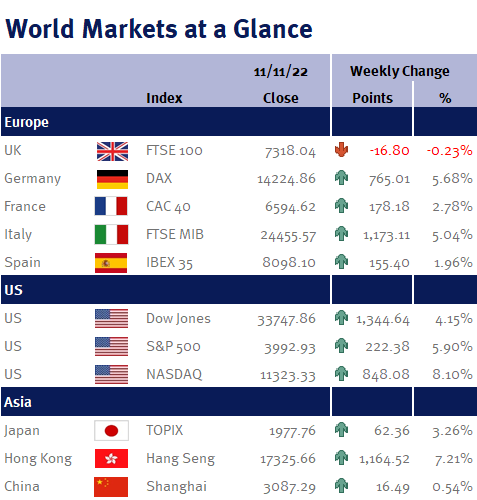

This was undeniably a big slowdown, and confirms our view that the high for inflation is well and truly behind us – and unsurprisingly, global equity markets rose sharply on the expectation that the Fed will not only start to slow its monetary tightening, but potentially start to cut interest rates next year.

Sentiment was also boosted by today’s US consumer sentiment data and news that China is easing some of its coronavirus restrictions: the University of Michigan consumer sentiment data added to the signs that the US economy is slowing (and thus added to the narrative that the Fed can slow its current monetary tightening); while the easing of quarantine for secondary contacts intensified speculation that this is the beginning of the end of China’s strict Covid-Zero policy, meaning that the China may soon join the rest of us living with the virus.