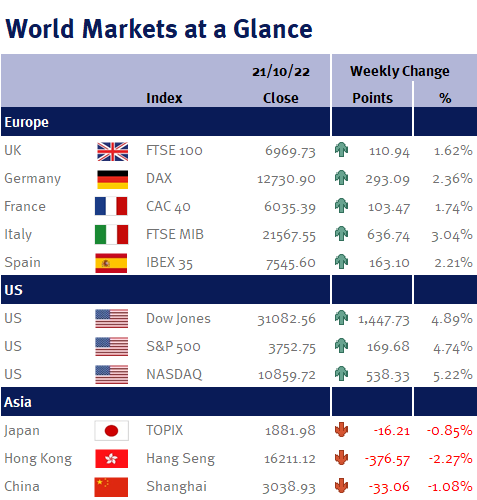

Inflation and interest rate expectations remained front-and-centre of the market’s focus this week following comments from a number of Fed policymakers that while further monetary tightening was needed, going forward interest rate increases may be in smaller increments to reduce the risk of overtightening – and as you can see from the accompanying table, the market reaction was very positive.

It was a similar story in the UK as Ben Broadbent, the BoE’s Deputy Governor this week confirmed what we have been arguing in these commentaries: market expectations for UK interest rates are far too high. And this suggests that bond yields will come down – which should help to lower the rates on new fixed-rate mortgages.

Equity market sentiment this week was also helped by better-than-expected company earnings statements. For example, in the US, in addition to the banks where earnings have been helped by higher interest income and a resilient consumer, Netflix ended the week up 25.9% after reporting Q3 results and subscriber growth; while the Lockheed Martin, the aerospace & defence company (famous for the F-35 fighter jet and Javelin anti-tank missiles), rose 16.74% following Q3 earnings which were accompanied by a higher dividend and share buy-back program.