In fact, the pound actually ended the week 2.15% stronger against the US dollar at $1.11 (having been as low as $1.035) – which means it is more or less back to where it was before Kwasi Kwarteng stood up and delivered his mini-budget!

Meanwhile, gilts also ended the week roughly where they started after some absolutely mind-blowing volatility: for example the yield on the 30 year gilt started the week at 4.04%, touched 5.14% on Wednesday, and then ended the week at 3.82% – which, like the value of the pound, is more or less where it was before the mini-budget.

Furthermore, despite this volatile backdrop, the UK Debt Management Office attracted bids of £30bn for a new £4.5bn 30-year green gilt issue.

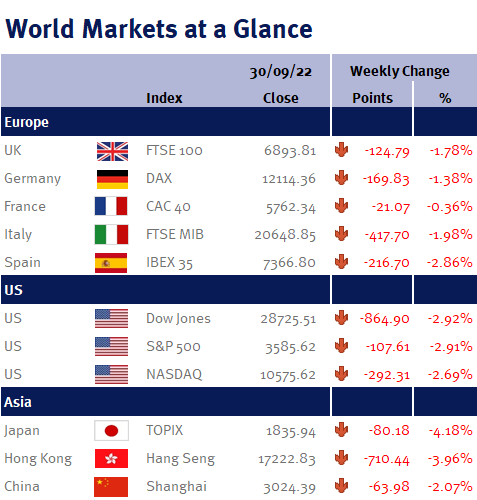

And as you can see from the accompanying table, while the FTSE-100 ended the week down, it was down less than the majority of the other major global equity indices.

However, before getting too excited not everything is all back to normal and hunky-dory: it is important to note that short-dated gilts, such as the 2 year gilt, have a significantly higher yield (4.17% compared to around 3.5% before the mini-budget), suggesting the market believes the BoE will speed-up the pace and size of UK interest rate increases to help contain inflation.

While we certainly aren’t defending Liz Truss or Kwasi Kwarteng, as their communication and execution of the mini-budget has been undeniably poor, it is important to remember that the roots of the current issues (high inflation and rising interest rates; and a cost of living crisis) go back to the coronavirus lockdowns and the war in Ukraine.

And on that note, this week we have had a number of well-known companies (such as Next, Carnival Cruises and Nike) warn about the economic outlook. This clearly highlights our concerns that consumers are already being pressured by the cost-of-living crisis and why we believe that central banks shouldn’t be unwinding their quantitative easing programs or aggressively increasing interest rates right now.

Looking ahead to this coming week we have US ISM; US mortgage data; US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings); US factory orders; Eurozone PPI inflation; Eurozone retail sales; Chinese PMI; and Japanese CPI inflation. Additionally, we have a number of central bank interest rates decisions, the most important of which include Australia and New Zealand.

Investment Management Team