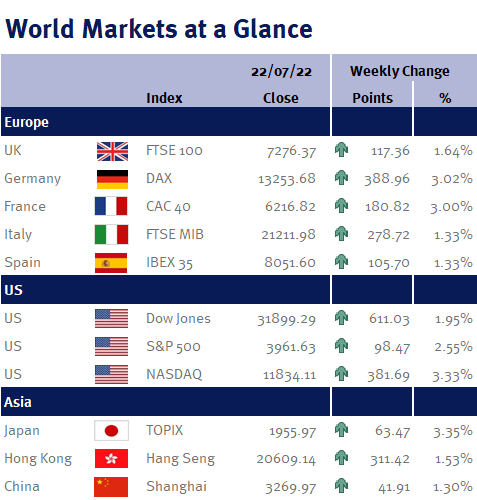

It has been a strong week for markets, seeing key markets well into positive territory over the week.

In the midst of heatwaves across Europe and North America (here in the UK, we saw record breaking temperatures, with the mercury hitting 40.3 degrees Celsius in Lincolnshire), the US president Joe Biden acknowledged climate change as a “clear and present danger”. Biden unveiled a $2.3 billion plan to deal with climate change; to build resilient infrastructure that can withstand extreme weather. This is great news for manufacturing jobs and spending in the region.

Over to Europe – the ECB’s (much anticipated) rate rise came this week – the central bank increased rates by 0.5%, which is a larger move than was initially floated by the central bank. This is the first increase since 2011, and brings the rates to 0%. As we said earlier in the week, this move to parity is a statement in itself, and hasn’t impacted markets negatively – in fact, Europe enjoyed a strong week for markets. The central bank is tackling the fine line between tempering near-term inflation and avoiding the economy slipping into recession.