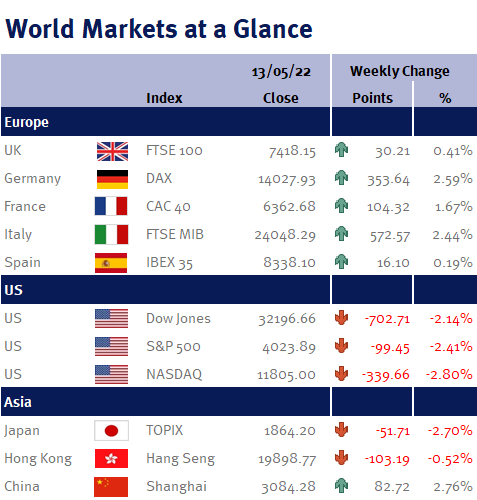

The end of the week brought Friday 13th – unlucky for some, but for many key markets it was a day of recovering early week losses.

The S&P 500 just held off hitting the definition of a bear market – a 20% drop from the all-time high value. On Thursday, the US index was within a hair’s breadth of this, before coming to its senses and making a recovery.

On Wednesday, US inflation was released for April and came in at 8.3% year-on-year (0.2% lower than prior), reaffirming our belief that price pressures are plateauing and beginning to stem. It must also be remembered that a large proportion of inflationary pressures were driven by food and energy price pressures, pressures which will likely be alleviated as the year goes on as Russian and Ukrainian agriculture and energy supplies redistribute and COVID-19-driven supply chains further ease.

As we said in last week’s update, in a bid to counter inflation, the Federal Reserve raised interest rates by 0.5%. One must remember that as inflation is a backwards looking measure, the increase in rates isn’t yet reflected in the inflation reading, as the 0.5% increase was essentially implemented after the fact. One must also remember a 0.5% move was a standard level shift in the pre-financial crisis in 2008/9 rates, so the current increase is merely a standard level increase, no more, no less.