It has been an exhausting week thanks to some savage equity market volatility, as in addition to navigating the war in Ukraine; higher inflation readings; and a struggling Chinese economy due to coronavirus lockdowns, we also had some big US companies reporting earnings.

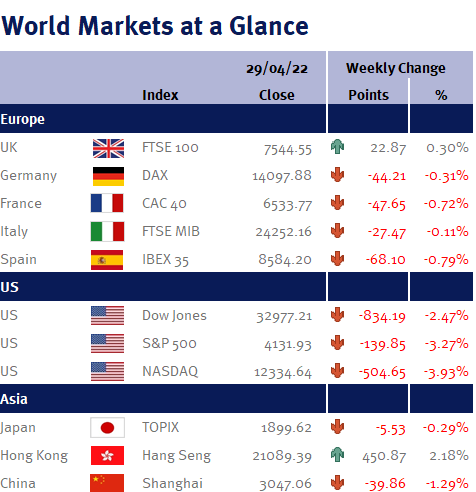

In summary, the week started with some large falls, for example, here in the UK, the FTSE-100 was down nearly 2.5% at one point, but thankfully recovered as the week wore on after China signalled it was determined to meet its economic targets – which suggests more economic stimulus is on its way.

The Politburo (the decision-making body of the Chinese Communist Party) confirmed that they will unveil further policy support. This support is promising for industries and firms hit by Covid-19. Whilst the detail was light, the message was clear, and strong enough to boost markets.

Xi Jinping, the president of China, wants to both ensure that his zero-Covid policy is a success, but also target 5.5% economic growth this year, ahead of the 20th party congress later in the year. If he secures a third leadership term, this will be unprecedented in recent history!