The price of a barrel of oil is one of the commodities that has seen volatility since the invasion of Ukraine, due to markets reacting on concerns over what a war could mean for global oil supply. However, as we have said previously, the issue at hand isn’t a lack of oil supply, but rather a need for reallocation of supply.

Whilst India condemns Russia, Modi, the prime minister of India, has been clear that he is willing to separate his political views from economic actions and has bought up discounted Russian oil. Following the EU’s announcement last week that they will ban imports of Russian coal, India is now eyeing up Russia’s coal too. This is despite warnings from Biden that India’s course of action would impede the intended actions of global sanctions against Russia, and that it is not in India’s interest to buy more oil from Russia.

These warnings are likely to be no more than posturing from the US, as the securing of discounted Russian energy is unlikely to have a severe impact on the Indian economy.

Looking at data this week, inflation in the US was first out of the gate at 8.5% for March, followed by the UK at 7%, giving us a snapshot of how the price of goods rose in the year to March.

As we have said previously, the war in Ukraine will exacerbate inflation, however there are pressures behind inflation that will ease, and help to bring inflation back down towards target levels, for example, Covid-19-induced supply chain bottlenecks that are gradually easing, and ultimately, a resolution to the tragic conflict.

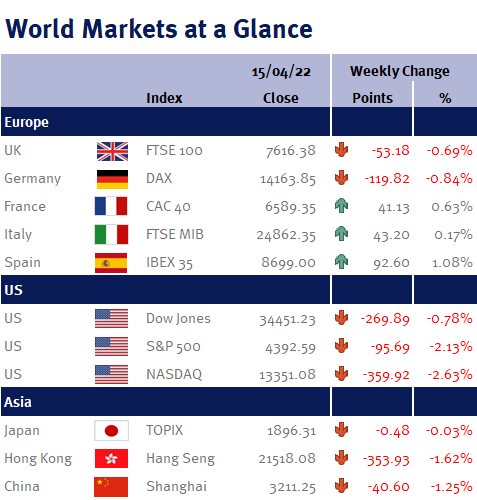

The FTSE didn’t have much of a reaction to this high level of inflation in the UK, as the majority of its revenue is derived from offshore. Furthermore, energy companies such as BP and Shell bounced on the news. The CPI figure is expected to pick up the pace again next month (when April’s figure is reported) given the rise in the energy price cap at the beginning of April.

In the latest policy announcement from the ECB on Thursday, they left interest rates unchanged, allowing them flexibility to monitor how the economy evolves, given the reopening of the economy after the crisis phase of the pandemic.

Next week (which is another four-day week for some markets), we have China Q1 GDP, Eurozone CPI, Eurozone consumer confidence and UK retail sales.

Hannah Owen, Portfolio Specialist