Following allegations of appalling civilian killings in Ukraine, we saw the EU, G7 and US pile on further pressure towards Vladimir Putin by coming together to coordinate further sanctions against Russia.

The newest raft of sanctions includes the US deploying full blocking sanctions against Russia’s largest private bank, Alpha bank and prohibiting new investment in the Russian federation by US persons.

The EU will ban various imports, including coal, which is a much easier tie for the EU to sever than oil and gas. These imports are thought to be worth around 4 billion euros per year, with some of the countries in the EU most reliant on coal being Poland, Germany and the Czech Republic.

As the EU has previously signed the Paris Agreement (agreeing to rapidly decarbonise its power sector), they are already on a path towards reducing the amount of coal used, and these sanctions could work in harmony with the EU’s long-term goals. On Friday, Japan also weighed in on sanctions, by announcing a ban on Russian coal imports.

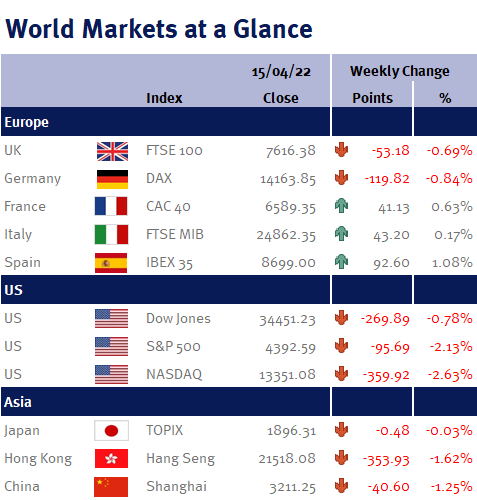

Global markets have been less reactive to this week’s sanctions when compared to earlier rafts of sanctions against Russia, showing markets have priced-in and braced themselves for the impacts and repercussions of war.