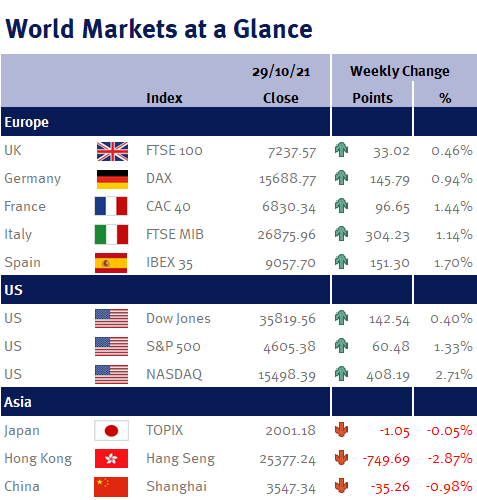

The majority of markets closed the week out stronger, with predominantly short-term noise causing elements of volatility throughout the period.

With the beginning of the week largely focused on the US and President Biden’s economic agenda, Wednesday saw arguably the most significant event of the week (for markets) begin, the 2 day policy meeting of the European Central Bank (ECB). Following the 2 day meeting, as expected, policy remained largely unchanged with the exception of the expectation of eliminating PEPP (pandemic emergency purchase program) by March 2022. However, it was the narrative from the ECB President, Christine Lagarde, the market dissected. With Largarde reluctant to comment on whether the market was ‘getting ahead of itself’ when pricing in interest rate rises, broader markets saw this as a hawkish sign that resulted in a rally in bonds and an element of nervousness in stock markets. However, we believe her narrative in the press conference was more about what she said, than what she didn’t… as Lagarde was clear that they firmly believe that supply chain bottlenecks will subside seeing inflation trend towards or below the 2% inflation target through 2022. With this message clear, she also pointed the finger at markets misinterpreting the ECB’s guidance, and that she will utilise ‘repetition’ in hope the message of low rates and normalised inflation will sink in! This further echoes our message of ‘transitory inflation’, and again represents a huge opportunity bred by market uncertainty.