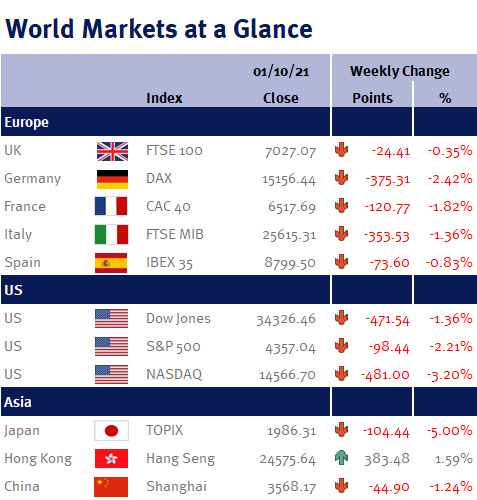

Global equity markets fell this week – and in doing so, ended September lower. For example, in the US, the S&P 500 index ended the month 4.76% lower (its first monthly decline since January 2021 – and its biggest monthly fall since March 2020 when it fell 12.51% due to coronavirus uncertainty). Thankfully the UK’s FTSE-100 index fared better, finishing September down just 0.47%.

Contributing to this weakness was inflation worries (and therefore potentially higher interest rates); continuing supply bottle-necks; a global energy crunch (in addition to the well documented collapse of a number of energy suppliers in the UK, it is actually starting to force factories to close in China); and US political wrangling (while Congress passed a stopgap funding measure it is yet to agree an increase in the country’s debt ceiling).

Also this week, China is closed until Friday (8 October 2021) for its Chinese National Day/Golden Week holiday.

With regards to oil, while the price of a barrel of Brent temporarily rose above $80 this week, we do have an OPEC meeting this coming week – and we believe that there is a strong chance that the cartel will increase their output quotas to help satisfy the recovering demand.