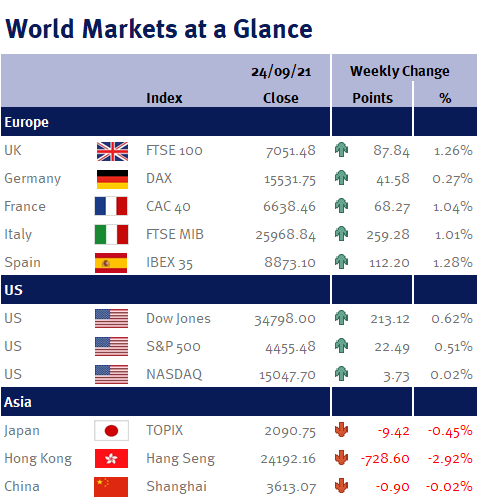

Despite the poor start to the week, when at one point on Monday (20th September 2021) the US equity markets were down nearly 3%, as you can see from the accompanying table, most of the major global equity markets ended the week in positive territory.

As we have previously said, history has shown us that global equity markets can deal with any eventuality, but hates periods of uncertainty – and equity markets got some certainty this week.

The week started with the Evergrande uncertainty – and the potential knock-on impact on financial markets if the highly indebted Chinese property developer was to collapse.

However, what really helped markets recover and end the week higher was the fact that the Fed finally provided us with some well-communicated plans on the speed and timing on the tapering of its QE programme.

Although the situation remains fluid, as we speculated, the Chinese authorities appear to have accepted the need to limit any potential contagion.