Global equity markets brushed aside Europe’s new lockdown restrictions and instead focused of the faster vaccine rollout in the US and the subsequent economic reopening, which bodes well for global economic growth and global equity markets.

Week ending 2nd April 2021.

6th April 2021

This economic recovery was clearly evident in yesterday’s (Thursday 1 April 2021) US ISM (Institute for Supply Management) data – and this helped the S&P 500 index close above 4,000 for the first time.

The S&P 500 tracks 500 large US companies – and so offers a better picture of the state of the US economy than its more famous cousin, the Dow Jones Index, which has just 30 constituents. Additionally, the Dow Jones is calculated on a price-weighted basis which means that the index performance is skewed heavily towards those companies with a high absolute share price, irrespective of its market capitalisation.

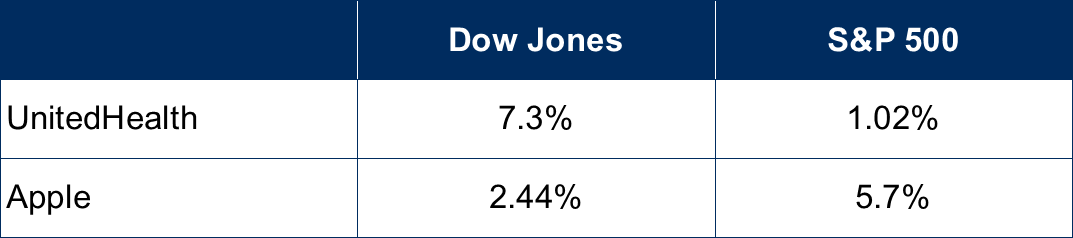

As a result, UnitedHealth Group, with a share price of $367, has the largest weight (7.3%) in the index, while Apple’s weight is only 2.44% (making it the 22nd largest weight in the Dow Jones) as its share price is only $123 – despite the fact that the market capitalisation of Apple is six-times more than UnitedHealth at just over $2tr versus just $347bn.

By way of comparison, the S&P 500 uses market capitalisation (just like the FTSE-100 index) and so larger companies constitute a larger percentage of the index, irrespective of their absolute share price – and as Apple is the largest company in the US (and in fact the world), its weighting in the S&P 500 is 5.70%, whereas UnitedHealth is the 12th largest and has a weight of 1.02%.

Going back to this week’s data, the ISM manufacturing reading jumped from 60.8 in February to 64.7 in March (its highest reading since Ronald Reagan oversaw the economic recovery from the recession in the early 1980s), while the employment reading rose from 54.4 to 59.6 – and as 50 is the line separating expansion and contraction, not only do these readings show that the US economy continues to recover, but more importantly, the recovery is accelerating.

Adding to the list of reasons to be optimistic about post-coronavirus economic outlook, Joe Biden this week announced plans to invest over $2tr on US infrastructure – although it is important to remember that infrastructure work can’t all of a sudden be turned on at a flick of a switch, so its impact, while positive, is unlikely to be seen for several years.

Looking ahead to this coming week, we can expect further rises in global equities thanks to today’s (Friday 2 April 2021) US employment data, as most equity markets were closed and therefore unable to react to the stunning data release, which showed that non-farm payrolls rose by 916,000 in March, while February’s employment rise was revised up by 89,000 to a 468,000 gain.

Our main attention this week will be focused on the minutes from the last Fed monetary policy meeting held on 17 March 2021, given the current inflation debate.

Data wise, from the US we have ISM services; weekly jobless claims; and factory orders. Elsewhere we have Eurozone unemployment; Chinese PMI and Chinese CPI inflation.

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.