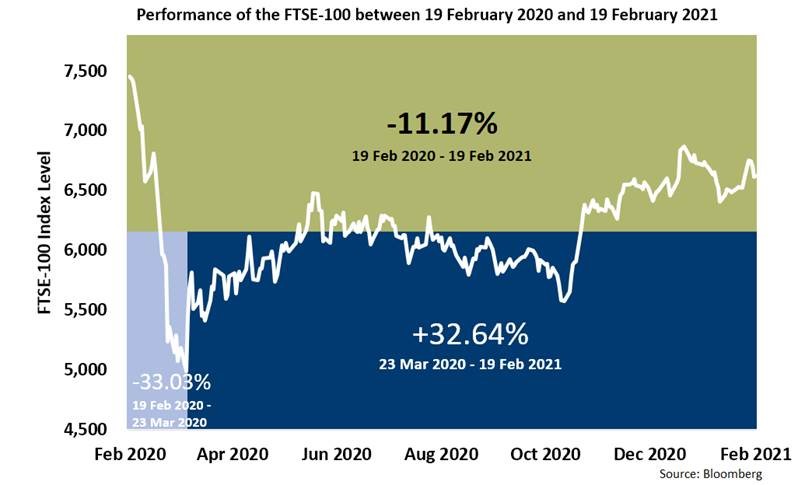

However, one year on and global equity markets have thankfully started to recover, with the FTSE-100 closing today (Friday 19 February 2021) at 6,624.02 – which means the FTSE-100 is now ‘only’ 11.17% lower than this time last year.

Although our portfolios were by no means immune from these losses, our disciplined process and active management process did help to protect against bigger losses – and over the same 12 month period, a typical Cautious risked client is up 2.33%; Balanced is down 0.30%; and Adventurous up 5.37%.

Back to this past week, we had some important data releases to analyse from the US given all the recent talk that inflation and interest rates will soon increase and/or the US doesn’t need Joe Biden’s proposed $1.9tr fiscal stimulus – as regular readers of these commentaries will know, we disagree with this.

And thankfully we weren’t left wanting.

First off was a score for growth: US retail sales smashed expectations, rising by a whopping 5.3% in January (way more than the 1.1% major economists expected); while US industrial production (which includes output from factories, mines and utilities), grew by 0.9% – which means it is now within spitting distance of the pre-coronavirus levels.

However, the need for low interest rates and more fiscal stimulus was laid bare for all to see in the US weekly jobless claims data. Not only did initial claims for unemployment benefit come in nearly 90,000 more than economist expected, but it came in higher than the previous week’s reading, which itself was revised upwards (which is bad) by 55,000.

As we have previously stated, the US central bank has a dual mandate of inflation and maximum employment – hence why we don’t see interest rates changing any time: while headline inflation will rise in the coming months thanks to the distorted oil price (and now, thanks to the unprecedented cold weather in the US, we may temporarily see higher food prices as crops will have undoubtedly been lost), the underlying inflation pressures are modest – and are likely to remain so as long as US unemployment remains high.

Thankfully, our views chime with Eric Rosengren, the President of Federal Reserve Bank of Boston, who this week pooh-poohed inflation fears saying he doesn’t expect to see a sustained above-target 2% inflation rate.

Looking at the week ahead, we have UK employment data (unemployment rate and weekly earnings); US jobless claims; Chicago Fed National Activity Index; US durable goods orders; the Fed’s preferred inflation measure, the PCE; and Japanese industrial production.

Investment Management Team