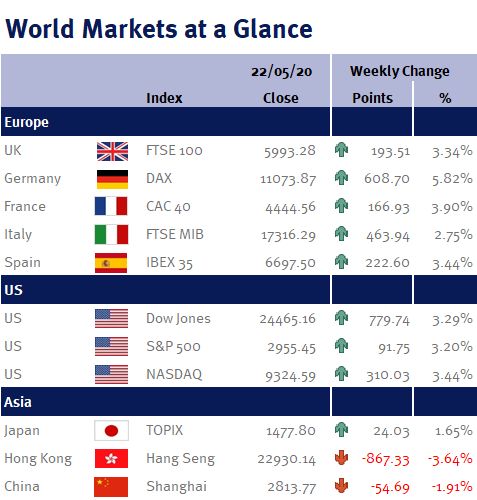

As you can see from the accompanying table, with the exception of Hong Kong and China, global equity markets rose strongly over the week – which more than recouped the previous week’s losses and clearly highlights the benefits of taking a long-term approach to investing. For a full explanation of why time in the market is more important than trying to time the market for long-term investment returns please see here.

This may seem bemusing given yesterday’s (21 May 2020) and today’s (22 May 2020) negative economic data and newsflow: US job losses have now totalled 38.6m in the past 10 weeks; and the escalating war of words between the US and China over coronavirus, Taiwan and Hong Kong (please see here).

However, the media tends to overcomplicate everything, when getting back to basics is the answer.

While the week’s economic data and newsflow has given us plenty to write about in our daily updates, and while not dismissing the potential impact on Hong Kong and its residents, equity markets’ main focus is on the economic impact of the coronavirus – and so far, while US unemployment has risen dramatically, as we explained on Wednesday (20 May 2020 – please see here), there’s little evidence to date that households are facing solvency issues. Additionally, we learnt from the global financial crisis in 2008/9 that governments and the major central banks had to return several times with larger stimulus packages before confidence started to return – and it is highly likely that Donald Trump will provide further stimulus given the US Presidential elections in November.

Furthermore, Anthony Fauci, America’s infectious disease expert said he was supportive of the US reopening its economy and expressed optimism about Moderna’s potential vaccine – and of course, a vaccine will speed up the global economic recovery.

This coming week, once again we will be keenly awaiting and analysing the weekly US jobless claims on Thursday (28 May 2020) – especially the continuing claims data, for clues if laid-off workers are being re-employed.

Other key US data releases include: the Chicago Fed national activity index; new home sales; the Fed’s Beige Book; and the Fed’s preferred inflation measure, the PCE.

Elsewhere we have Eurozone CPI; Chinese PMI; and Japanese retail sales – so be sure to keep reading our daily updates to stay on top of our thoughts and views for all these market moving events.

Investment Management Team