After the recent wonderful news that new coronavirus infections in Italy and Spain were slowing, global equity markets have opened lower this morning after both the UK and New York reported an increase in daily deaths from the virus.

Unfortunately, because equity markets hate uncertainty, they are currently trading on every news headline – and as such we expect equity market volatility to remain elevated.

It is safe to say that we can all see the evidence of the economic damage that is being inflicted as the global economy has effectively hit a brick wall thanks to the coronavirus lockdown and containment measures.

As such it is obvious that the global economy is currently entering its deepest recession in decades and as a result we are set to see some horrendous economic data and substantial falls in company profitability.

Given our positivity (we see plenty of long-term opportunities in equity markets), versus the economic outlook, you may be questioning our sanity. However, given the speed and magnitude of the recent equity market falls, we believe that equity markets have now already priced-in all this bad economic and company news and then some – in fact, we believe that markets are pricing-in the worst possible case scenario, i.e. a severe and protracted economic downturn, rather than, as we expect, a sharp, but short recession and a V-shaped recovery.

We all know that consumer spending will be restrained for several months; and that we are many months away from the ultimate peak in unemployment; GDP will turn negative; and sporting events such as Wimbledon have been cancelled and the Summer Olympics has been postponed until 2021. But when the lockdowns are lifted and the economy reopens, consumer confidence and spending will quickly recover thanks to the incredible stimulus response from government and central banks, which will help cushion the pain for companies and furloughed employees – and as the consumer accounts for around two-thirds of the US and UK economies, economic growth will therefore quickly turn positive.

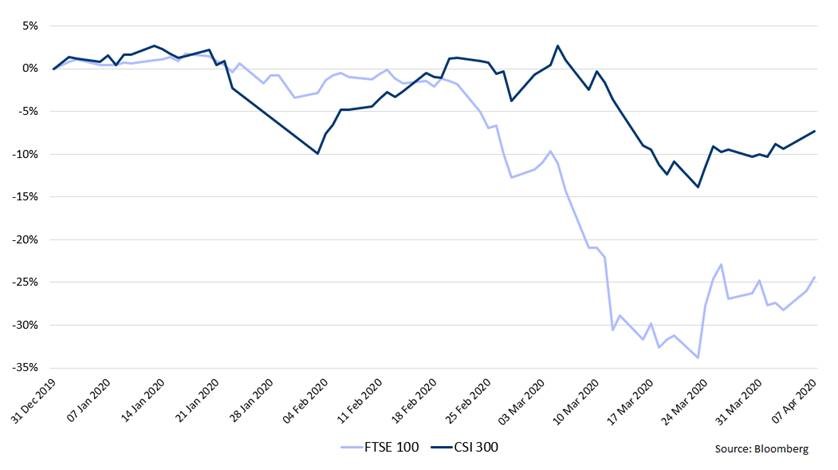

Additionally, as you can see from the accompanying chart, we are taking comfort in our V-shaped recovery stance from the fact that Chinese equities, while down, have held up much better as their economy is already starting to recover. For example, as we highlighted in our daily update on 31 March 2020 (please see here), Chinese PMI (Purchasing Managers’ Index) data showed that their economy was already moving back into expansion territory.

While we aren’t blinkered and remain open minded, we aren’t prepared to react to the ebb and flow of daily noise and headlines, unless it truly is new and clear evidence to the contrary of our current views – i.e. the economic backdrop is deteriorating faster and harder than we currently believe to be the case.

Consequently, we continue to look at the long-term opportunities for global equities (which have weathered and recovered from lots of negative and uncertain events in the past), as once this horrible outbreak is contained, companies will have the benefit of operating in a world full of cheap input costs (thanks to the lower oil price), a looser labour market (and therefore subdued wage growth) and an accommodating monetary policy.

As for today, our attention will be firmly on the Fed minutes from their emergency monetary policy meeting on 15 March 2020, as we will be looking at policymakers thinking and looking for clues on any potential policy responses still to come.