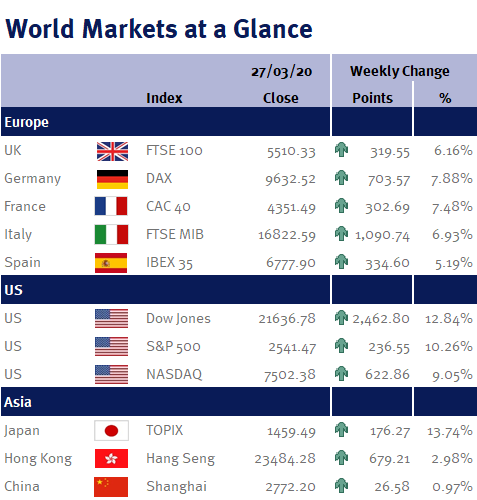

Global equity markets rallied strongly this week on optimism that America’s $2tr fiscal stimulus will mitigate the economic impact of the coronavirus outbreak. For example, in the US, the Dow Jones rose nearly 13%, while the broader S&P 500 index ended the week just over 10% higher after recording its strongest three-day advance since the 1930s – although they remain well below levels since the last client valuation dated 5 January 2020 (the S&P 500 is down 21.43%, while in the UK, the FTSE-100 is down 27.71%).

However, that’s not to say we only saw global markets rise – in fact we still saw big swings in both directions almost every day this week given the mixed newsflow. For example, we saw a record jump in US unemployment and news that the US is poised to overtake China as having the most coronavirus cases. Nevertheless, we were able to take comfort from the signing of the US fiscal stimulus, coupled with central bank comments and actions: the Fed Chair, Jay Powell, reassured us that the US central bank is not going to run out of ammunition to fight this economic downturn, while the ECB boosted its firepower by scrapping its bond-buying limits for the pandemic emergency purchase program.

However, while all the global monetary and fiscal policy stimulus is both correct and necessary given the speed and magnitude of the economic damage from the coronavirus outbreak, having experienced a number of crises (including the 1987 crash, the 1997 Asian financial crisis, the dot-com bubble, 9/11 terrorist attacks and the global financial crisis in 2008/9), unfortunately, it is safe to say that volatile markets will remain the norm until we see a slowing in the spread of the coronavirus outbreak and lockdowns lifted, as equity markets hate uncertainty – and the coronavirus outbreak is a big uncertainty.

While we appreciate that this volatility is unnerving, it is important to maintain a long-term perspective as we often see and hear clients wanting to sell their investments after equity markets have fallen: people have an interesting characteristic in that generally the cheaper an investment gets the less people want to invest! That characteristic is not reflected elsewhere – for example, consumer purchases, as we all enjoy shopping for bargains in the sales on the high street.

In the meantime, we want you to know that we are doing everything we can to ensure you are kept fully up to date and with that in mind, we have been reasonably active this week.

We repurchased many of the Barclays shares at 103.3p that we sold earlier in the month at 118.6p due to the strength and visibility of its capital position. We also increased clients’ weightings in BHP and Glencore, as they have both fallen heavily due to the weaker global economic outlook, but with China starting to recover their risk/reward now looks compelling. However, following the strong rise in US equities we slightly reduced our US exposure by reducing the JPMorgan US Equity Fund. As a result, while we remain positive on equities over the long-term, particularly those in Asia and Emerging Markets, we have maintained our short-term cautious stance with a slightly higher than normal level of cash (including liquidity funds) at around 10% in the Cautious, Balanced and Adventurous risked portfolios – and when we see opportunities arise we will start to reduce this cash balance by adding to your investments.

Investment Management Team