It felt like this day would never come, but Brexit may finally be here!

However, everything depends on the outcome of tomorrow’s (Saturday 19 October 2019) Parliamentary session when MPs vote on the deal.

21st October 2019

It felt like this day would never come, but Brexit may finally be here!

However, everything depends on the outcome of tomorrow’s (Saturday 19 October 2019) Parliamentary session when MPs vote on the deal.

Given the arithmetic is very tight, Parliamentary approval looks difficult especially as the DUP has rejected the deal. If the deal is not approved by MPs, under the Benn Act, Boris Johnson will be forced to ask for an extension, potentially followed by a confidence vote and then a General Election.

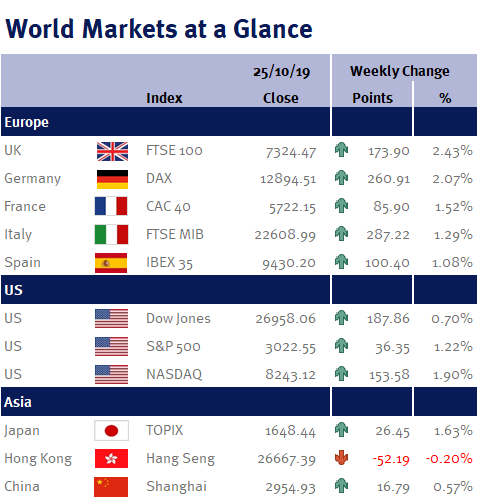

The pound strengthened over the week on news of the Brexit deal and this coupled with weaker commodity prices meant that the FTSE-100 lagged behind the other major markets. The FTSE-100 has a large exposure to oil and mining stocks and commodity prices have weakened on slowing global economic growth, while around two-thirds of the FTSE-100’s total revenue is derived from abroad, so a stronger pound is a headwind to exporters and those companies with significant overseas earnings.

Interestingly, the BoE Deputy Governor, Dave Ramsden, said today (Friday 18 October 2019) that if Boris Johnson secures Parliamentary backing for his Brexit deal, then interest-rate increases could rise in the UK.

Given the current economic uncertainty and mounting downside risks to global economic growth, we believe that the BoE’s stance will be difficult to maintain and policymakers will actually be compelled to reduce interest rates.

In fact, this week’s data further cements our view that the BoE needs to reduce, not increase, UK interest rates. UK employment data showed that unemployment rose by 56,000 in August, meaning that the unemployment rate rose from 3.8% to 3.9%, while wage growth eased from 4% to 3.8%. Additionally, UK CPI inflation was unchanged last month at 1.7%, well below the BoE’s 2% target.

Additionally, the IMF cut its global growth outlook for 2019 to 3% – the slowest pace of growth in a decade, as global growth is clearly being impacted by the current US/China trade differences. For the US, the IMF now estimates 2019 growth of 2.4% (down from growth of 2.9% in 2018), while Chinese projections were cut to 6.1% (2018 growth was 6.6%).

Elsewhere, the Fed’s Beige Book now describes US growth as “slight to modest” – it was previously a “modest pace” as manufacturing is weakening. This should help ensure the Fed cuts US interest rates during their next policy meeting at the end of October.

We have a reasonably quiet economic calendar week ahead. Thursday’s (24 October 2019) ECB monetary policy meeting and Friday’s University of Michigan Consumer Sentiment Index are the week’s key economic events.

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.