While it has been an interesting week watching the latest political turmoil unfold in both the UK and US, it should be noted that this is just a sideshow as the main driver for markets is still the US/China trade talks (as this impacts global economic growth and corporate profitability).

Week ending 27th September 2019.

30th September 2019

We are not saying Donald Trump’s impeachment is not a serious matter, but it is not necessarily a negative for equity markets. The last President to be impeached was Bill Clinton in 1998, and US equities made it through the run-up to the impeachment and the subsequent impeachment trial unscathed. In fact, in 1998 the S&P 500 rose 26.67% and then rose a further 19.53% in 1999.

While we are unlikely to see similar returns during Donald Trump’s impeachment, it is important not to panic over the negativity of the news headlines.

Likewise, in the UK, the Supreme Court’s ruling that Boris Johnson broke the law by suspending parliament may have allowed MPs to reconvene, but doesn’t materially alter the options: Will Brexit be delayed? Will there be a general election? And if so, when?

The pound moved lower over the week after Boris Johnson stuck to his line that negotiations are progressing and the UK will leave the EU on 31 October 2019, while BoE policymaker, Michael Saunders, said it was plausible that the next move in UK interest rates “would be down rather than up” even if the UK avoided a no-deal Brexit.

This is significant, as Michael Saunders is usually one of the more hawkish policymakers, having voted for higher interest rates in 2017 and 2018 and, only a few months ago, was saying the interest rates need to rise as the UK economy might overheat!

We have long been advocates of lower UK interest rates despite the overwhelming market consensus for interest rate increases. With Michael Saunders finally acknowledging the current economic uncertainty and mounting downside risks to global economic growth, hopefully it is only a matter of time before the rest of the BoE policymakers will be compelled to reduce UK interest rates and make this one of the loosest tightening cycles ever.

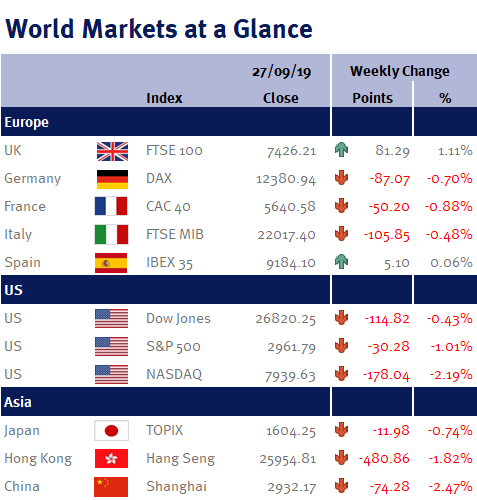

The weaker pound is positive for the FTSE-100 (as around three-quarters of the FTSE-100’s total revenue is derived from abroad – so a weaker pound enhances returns for exporters and the value of overseas earnings), hence why the FTSE-100 was one of the best performing markets over the week.

Back to US/China trade talks, there were signs of warming trade relations despite reports that the US is unlikely to extend a waiver allowing US companies to supply China’s Huawei Technologies, after US and China officials described last weekend’s talks in Washington as “constructive” and “productive”, while Donald Trump said a trade deal with China is getting “closer and closer” and “could happen sooner than you think”.

Donald Trump also said that the US and Japan had agreed on a new trade pact that eases access for US food and agricultural goods.

Elsewhere, Eurozone PMI data was poor, with German manufacturing PMI falling to 41.4 in September from 43.5 in August, which suggests the German economy will slip into recession. The question now is whether or not the ECB’s recent interest rate cut is enough to stem the downturn and encourage activity or whether more stimulus is needed.

The main focal point for this week’s economic data will be Friday’s (4 October 2019) US employment data (non-farm payrolls; unemployment rate; participation rate; and average earnings). Additionally we have Eurozone unemployment and CPI inflation and Chinese PMI data.

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.